What Happens When A Garnishment Is Paid - Page 2

What is What happens when a garnishment is paid?

When a garnishment is paid, it means that the debt or obligation being enforced through the garnishment has been satisfied. This could be a court-ordered payment to a creditor or a government agency. Once the garnishment is paid in full, the withholding of wages or assets stops.

What are the types of What happens when a garnishment is paid?

There are several types of garnishments that can be paid off, including:

Wage garnishment

Bank account garnishment

Tax refund garnishment

Property lien garnishment

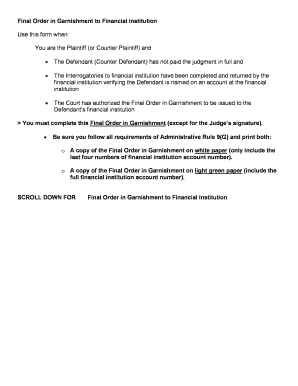

How to complete What happens when a garnishment is paid

To successfully complete the process of paying off a garnishment, follow these steps:

01

Determine the total amount owed including any interest or fees.

02

Contact the creditor or agency enforcing the garnishment to verify the amount and payment options.

03

Make arrangements to pay the garnishment in full or set up a payment plan if needed.

04

Keep records of all payments made and confirm with the creditor or agency when the garnishment is paid off.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out What happens when a garnishment is paid

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Does a garnishment affect your credit?

The garnishment doesn't just hurt your budget, but it can also drag down your credit scores. Although wage garnishments don't appear directly on your credit reports, that doesn't mean they're invisible to lenders.

Why is a garnishment bad?

If they win the suit, the court may pass a wage garnishment order allowing the debt collector to deduct a portion of your income to settle the debt. A wage garnishment order affects your finances, making it difficult to fulfill your financial responsibilities.

How will a garnishment affect my credit score?

Wage Garnishment Isn't Included on Your Credit Report From a credit perspective, the damage has more or less been done. Since your wages are likely being garnished as a result of having missed payments on one or more debts, your credit may have been dinged, but it was the missed payments that hurt your score.

What is the most they can garnish from your paycheck?

For ordinary garnishments (i.e., those not for support, bankruptcy, or any state or federal tax), the weekly amount may not exceed the lesser of two figures: 25% of the employee's disposable earnings, or the amount by which an employee's disposable earnings are greater than 30 times the federal minimum wage (currently

What are the garnishment laws in Missouri?

Under Missouri law, for any workweek, a creditor can garnish the lesser of: 25% of your disposable earnings, or 10% of your disposable earnings if you're the head of a family and a resident of the state, or. the amount by which your weekly disposable earnings exceed 30 times the federal hourly minimum wage.

How long does a garnishment affect your credit?

A garnishment judgment will stay on your credit reports for up to seven years, affecting your credit score. But there are a few easy ways to bolster your credit, both during and after wage garnishment.