Tuition Reimbursement Policy Pdf

What is Tuition reimbursement policy pdf?

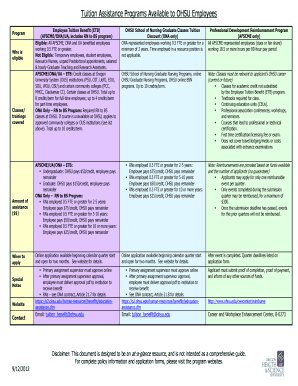

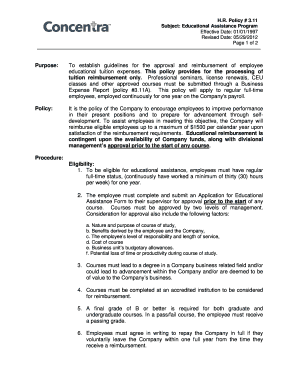

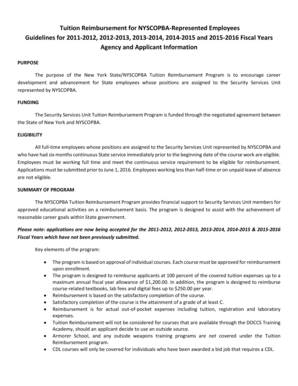

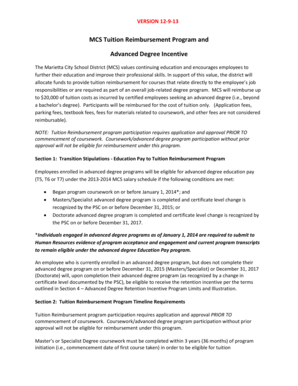

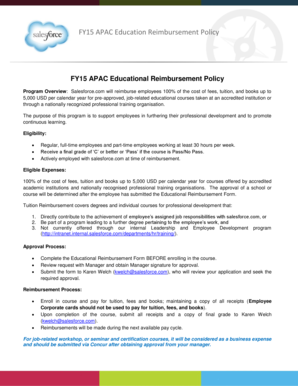

A Tuition reimbursement policy PDF is a document outlining an organization's guidelines and procedures for assisting employees with the cost of education. It usually includes information on eligible programs, reimbursement limits, application process, and other relevant details.

What are the types of Tuition reimbursement policy pdf?

There are several types of tuition reimbursement policy PDFs that organizations may adopt based on their needs. Some common types include:

Traditional tuition reimbursement policy - where employees pay upfront for education and are reimbursed by the employer upon successful completion.

Direct bill payment policy - where the employer pays the educational institution directly.

Loan assistance policy - where the employer offers low-interest loans to employees for education expenses.

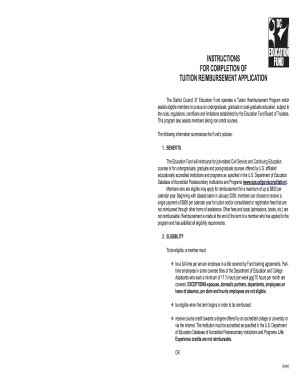

How to complete Tuition reimbursement policy pdf

Completing a tuition reimbursement policy PDF is a straightforward process that typically involves the following steps:

01

Review the company's tuition reimbursement policy to understand eligibility criteria and reimbursement process.

02

Fill out the reimbursement application form with necessary details such as course information, costs, and proof of completion.

03

Submit the completed form along with any required documentation to the HR department for review and approval.

04

Upon approval, receive reimbursement for eligible expenses as per the policy guidelines.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Tuition reimbursement policy pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

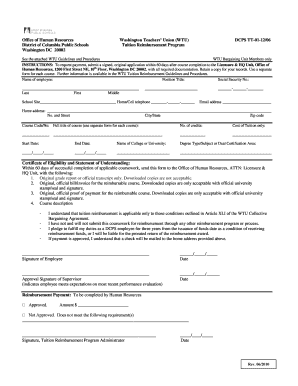

What are the federal guidelines for tuition reimbursement?

IRS regulations limit tuition reimbursement programs to $5,250 per year for tax-free benefits. If your company reimburses you less than that amount, you should not have any benefits to report on your annual tax return. Tuition benefits paid beyond that amount would be subject to taxation.

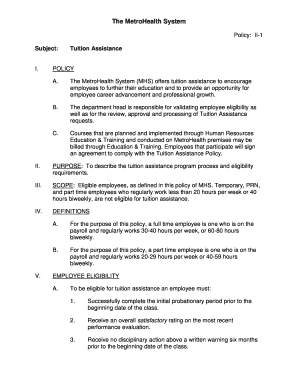

How does tuition reimbursement work at work?

In most cases, tuition reimbursement works as it sounds: A company reimburses a worker for classes after the employee has paid for the course. As the student, you'll need to pay for your tuition and fees upfront.

How is tuition reimbursement reported on W-2?

These amounts should be included in your wages in Box 1 of Form W-2. However, if the payments over $5,250 qualify as a fringe benefit, your employer does not need to include them in your wages. A fringe benefit is a benefit you could deduct as an employee business expense had you paid for it.

How does tuition reimbursement work from employer?

Tuition reimbursement plans allow workers to pursue specific degrees and certificates, with the company contributing a set amount of money. Tuition assistance programs may offer upfront financial assistance, while reimbursement programs pay employees back after they complete a course or semester.

How do I ask my employer for tuition reimbursement?

Make a Plan to Ask about Tuition Reimbursement Research the program you plan to apply to, find its tuition cost, and outline the classes you plan to take. Also find out whether your company's competitors offer tuition reimbursement and consider mentioning it during your meeting.

What is the IRS rule for tuition reimbursement?

If the company you currently work for has provided funds for educational assistance such as tuition reimbursement or employer student loan repayment, you may exclude an amount from your taxable income. This amount goes up to $5,250.