Tuition Reimbursement Policy Small Business

What is Tuition reimbursement policy small business?

Tuition reimbursement policy is a beneficial program offered by small businesses to assist their employees in furthering their education. This policy typically outlines the guidelines and procedures for employees to receive financial assistance for courses or degrees related to their job or career development.

What are the types of Tuition reimbursement policy small business?

There are several types of tuition reimbursement policies that small businesses may offer to their employees. Some common types include:

Full reimbursement: The employer covers all tuition costs for approved courses or programs.

Partial reimbursement: The employer covers a portion of the tuition costs, with the employee responsible for the rest.

Cap on annual reimbursement: The employer sets a maximum amount that can be reimbursed to each employee per year.

Reimbursement for specific fields: Some businesses may only provide reimbursement for courses or programs related to the employee's current job or future career goals.

How to complete Tuition reimbursement policy small business

Completing a tuition reimbursement policy in a small business can be a straightforward process with the following steps:

01

Review the company's existing policy or create a new one that outlines the eligibility criteria, reimbursement limits, and application process.

02

Communicate the policy to employees in a clear and concise manner, highlighting the benefits of furthering their education.

03

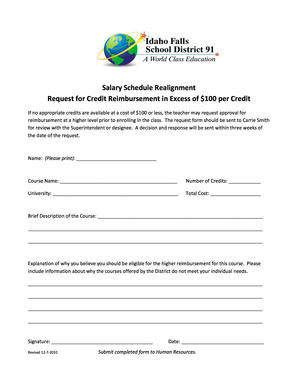

Establish a procedure for employees to submit reimbursement requests and provide any necessary documentation.

04

Regularly review and update the policy to ensure it remains relevant and aligns with the company's goals and budget.

05

Consider using tools like pdfFiller to create, edit, and share the policy with ease, ensuring all employees have access to the necessary information.

pdfFiller empowers users to create, edit, and share documents online, making it easier for small businesses to implement and manage their tuition reimbursement policies effectively.

Video Tutorial How to Fill Out Tuition reimbursement policy small business

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the tuition reimbursement policy for employees?

Tuition reimbursement offers employees money for taking college courses while employed with your company. The employee will typically pay for their courses, and the employer reimburses these costs upon course completion.

Do companies actually make you pay back tuition reimbursement?

Employers require tuition reimbursement payback agreements to avoid training employees who use their education to get a new job working elsewhere. Companies legally protect themselves by making employees pay back reimbursements if the employee leaves the company within a specific time frame of completing the education.

Is employer tuition reimbursement reported to IRS?

First, the reimbursements that you received through your employer's program count as “unearned income” for tax purposes. “Unearned income” is reported on line 21 of your Form 1040.

What is the average amount employer pays for employee tuition reimbursement ($)?

No two tuition reimbursement programs are equal, and this gives freedom to organizations. On average, employers pay $5,250 for undergraduate and $10,500 for graduate degrees. Yet, each organization places a cap on how much they cover, what courses qualify for reimbursement, etc.

What is the threshold for tuition deduction?

To claim the full credit, your MAGI, modified adjusted gross income (See Q&A 13 for MAGI definition) must be $80,000 or less ($160,000 or less for married taxpayers filing jointly).

Can businesses write off tuition reimbursement?

Tuition Reimbursement Helps Offer Tax Breaks As long as your company has a written policy meeting federal income tax guidelines, employers can deduct up to $5,250 in reimbursements (per employee) from their own taxes each year.