Tuition Reimbursement Laws

What is Tuition Reimbursement Laws?

Tuition reimbursement laws are regulations that require employers to either partially or fully reimburse employees for the costs associated with continuing their education. These laws aim to encourage employees to pursue further education and enhance their skills without experiencing financial burdens.

What are the types of Tuition Reimbursement Laws?

There are several types of tuition reimbursement laws that vary from state to state. Some common types include:

State-mandated tuition reimbursement laws

Company-specific tuition reimbursement policies

Federal tuition reimbursement regulations

How to Complete Tuition Reimbursement Laws

Completing tuition reimbursement laws can be a straightforward process if you follow these steps:

01

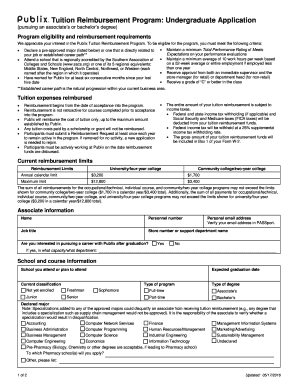

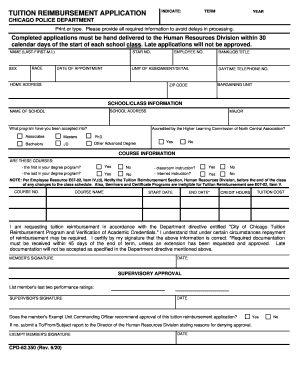

Educate yourself on the specific laws and policies in your state or company

02

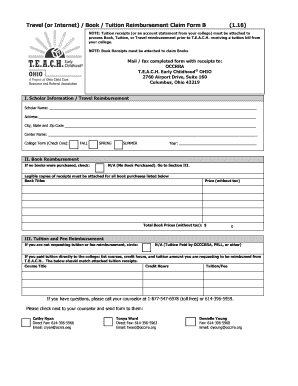

Gather all relevant documentation, such as receipts and proof of enrollment

03

Submit a formal request for reimbursement to your employer

04

Adhere to any deadlines or requirements set forth by the laws or policies

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Tuition reimbursement laws

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Why is tuition reimbursement 5250?

By utilizing a Code 127 program, both employers and employees will avoid federal payroll taxes on qualifying payments, and employees will save on federal income taxes that would otherwise apply. There is a limit to these programs and that limit is $5250 per year.

Do companies actually make you pay back tuition reimbursement?

FAQs about tuition reimbursement programs You can require an employee to pay back the tuition reimbursement if they leave your company voluntarily within a set amount of time.

What is the IRS limit for tuition reimbursement in 2023?

If your employer pays more than $5,250 for educational benefits for you during the year, you must generally pay tax on the amount over $5,250.

How does tuition reimbursement work at work?

In most cases, tuition reimbursement works as it sounds: A company reimburses a worker for classes after the employee has paid for the course. As the student, you'll need to pay for your tuition and fees upfront.

What are the federal guidelines for tuition reimbursement?

IRS regulations limit tuition reimbursement programs to $5,250 per year for tax-free benefits. If your company reimburses you less than that amount, you should not have any benefits to report on your annual tax return. Tuition benefits paid beyond that amount would be subject to taxation.

What is a Section 127 tuition reimbursement plan?

Federal Law. Existing federal law, (IRC section 127) provides an exclusion of up to $5,250 per year from gross income of an employee, for educational assistance furnished pursuant to an educational assistance program by an employer, for expenses incurred by, or on behalf of, an employee for education of the employee.