Paying Back Tuition Reimbursement To Employer Taxes

What is Paying back tuition reimbursement to employer taxes?

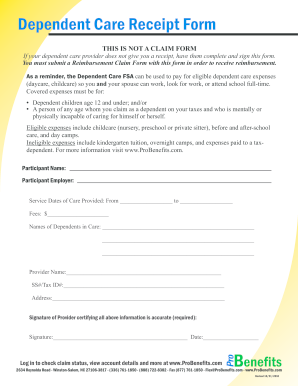

When an employer provides tuition reimbursement to an employee and the employee leaves the company before a certain period of time, they may be required to pay back a portion of the reimbursement. This repayment is subject to taxes and must be reported accurately on tax returns.

What are the types of Paying back tuition reimbursement to employer taxes?

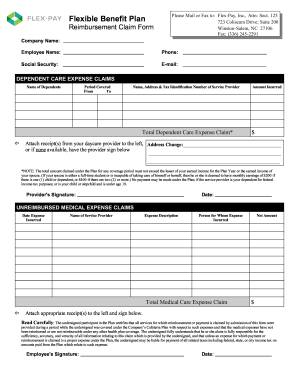

There are two main types of taxes associated with paying back tuition reimbursement to an employer: income tax and potentially, self-employment tax.

Income Tax

Self-Employment Tax

How to complete Paying back tuition reimbursement to employer taxes

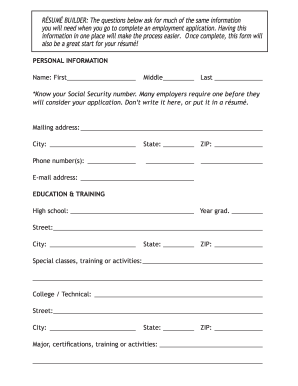

To complete the process of paying back tuition reimbursement to an employer for tax purposes, follow these steps:

01

Gather all relevant documentation related to the tuition reimbursement and repayment.

02

Determine the amount of reimbursement that needs to be paid back based on company policy and tax regulations.

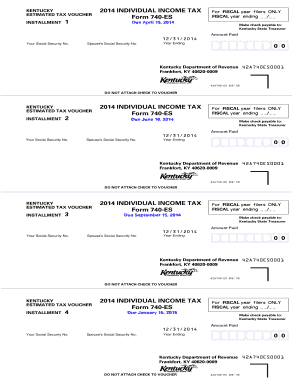

03

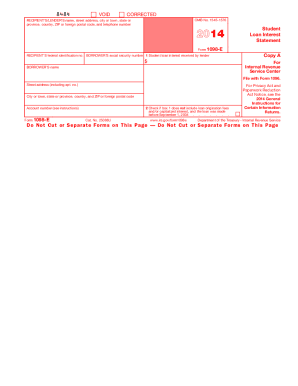

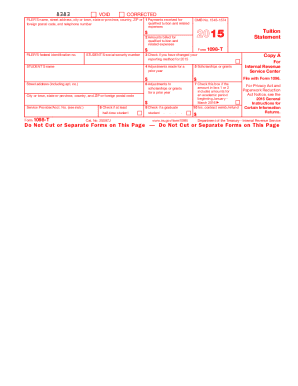

Report the repayment amount accurately on your tax return, ensuring to include any applicable taxes.

04

Keep records of the repayment for future reference in case of audits or disputes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Paying back tuition reimbursement to employer taxes

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Does my employer report tuition reimbursement to IRS?

You must generally pay tax on any educational assistance benefits over $5,250. These amounts should be included in your wages in Box 1 of Form W-2. However, if the payments over $5,250 qualify as a fringe benefit, your employer does not need to include them in your wages.

Is tuition reimbursement taxable to employer?

Employees already can receive $5,250 in tuition reimbursement free from federal taxes, at least until Jan. 1, 2026. Any amount over $5,250 should be reported as taxable income by the employee. Likewise, up to $5,250 of tuition reimbursement per employee per year is tax-deductible for the employer.

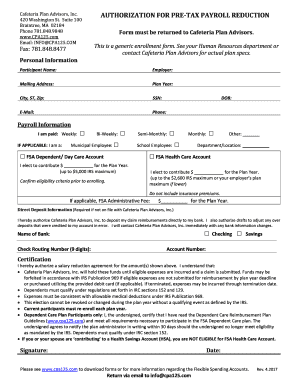

Does tuition reimbursement go through payroll?

Companies might pay the tuition reimbursement during their regular pay cycle so that it appears on the employee's paycheck. Or a company might choose to cut a separate check for tuition reimbursement. Another caveat some tuition reimbursement programs have is a clawback period.

Do companies actually make you pay back tuition reimbursement?

FAQs about tuition reimbursement programs You can require an employee to pay back the tuition reimbursement if they leave your company voluntarily within a set amount of time.

What is a clawback employer tuition reimbursement?

One example is having a “clawback clause” which tells employees they will be forced to repay any reimbursed tuition if they don't commit to staying with an employer for at least 2 years after using the benefit.

Is tuition reimbursement tax deductible for employees?

Under Internal Revenue Code Section 127, employers can deduct up to $5,250 per employee for tuition reimbursements made through qualified education assistance programs (EAPs). EAP benefits are also tax-free for employees, making them even more attractive as part of your benefits package.