Cobra General Notice 2020

What is Cobra general notice 2020?

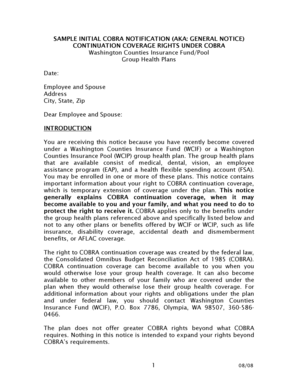

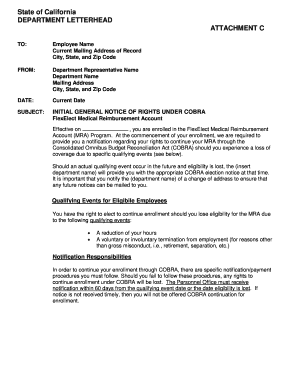

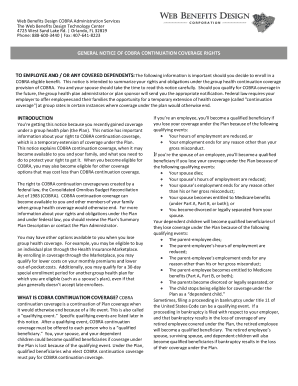

The Cobra general notice 2020 is a formal document that provides information to employees and their families about their rights to continue their health insurance coverage after experiencing a qualifying event, such as a job loss or reduction in work hours. It outlines the rights and responsibilities of both employers and employees in regards to maintaining health insurance coverage through the Consolidated Omnibus Budget Reconciliation Act (COBRA) provisions.

What are the types of Cobra general notice 2020?

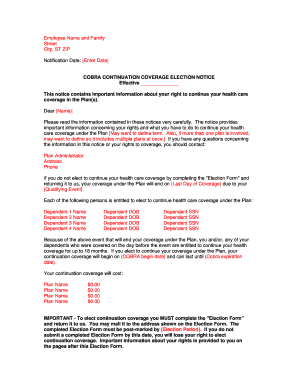

There are two main types of Cobra general notices in 2020: the Initial Notice and the Election Notice. The Initial Notice is typically provided by the employer to the employee and their eligible dependents when they first become eligible for COBRA coverage. The Election Notice is sent to the employee and their dependents after a qualifying event has occurred and explains their options for continuing coverage.

How to complete Cobra general notice 2020

Completing the Cobra general notice 2020 is a straightforward process that involves following these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.