Cobra Letter To Employee 2020 Template - Page 2

What is Cobra letter to employee 2020 template?

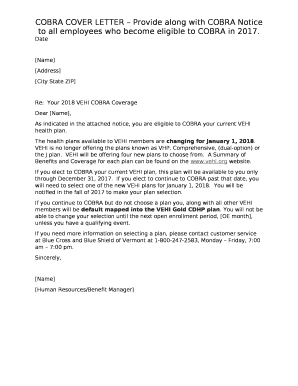

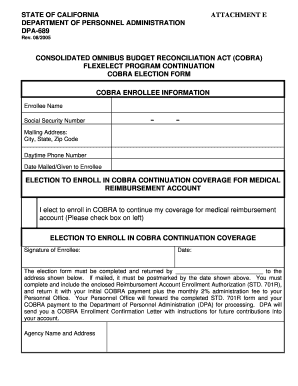

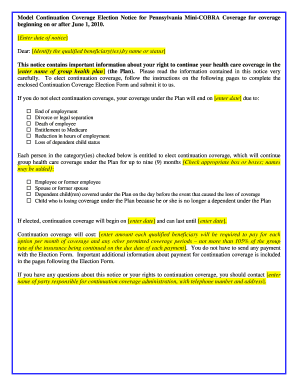

The Cobra letter to employee 2020 template is a standardized document that employers use to inform their employees about their rights to continue their health insurance coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA) in 2020.

What are the types of Cobra letter to employee 2020 template?

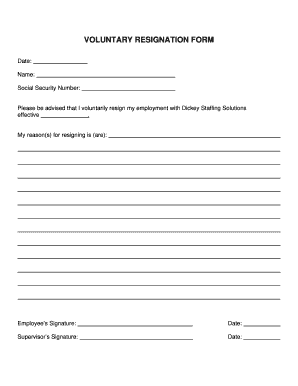

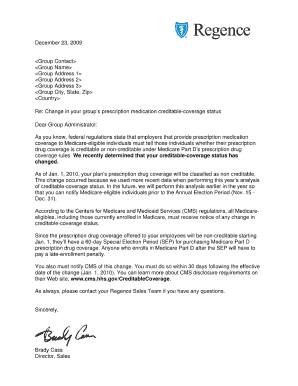

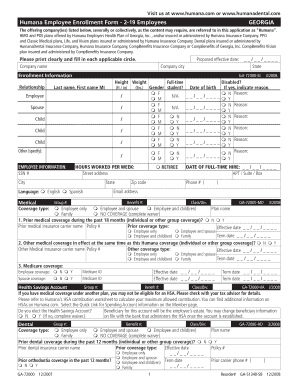

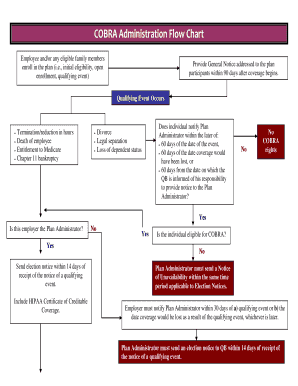

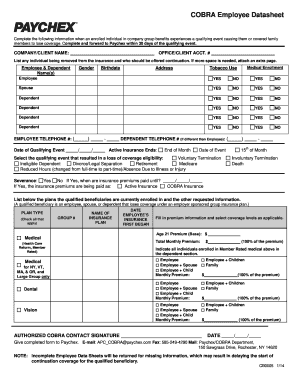

There are different types of Cobra letter to employee 2020 templates based on the reason for the coverage loss, such as voluntary or involuntary termination, reduction in hours, divorce, legal separation, or Medicare entitlement. Each template includes specific information relevant to the situation.

How to complete Cobra letter to employee 2020 template

Completing the Cobra letter to employee 2020 template is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.