Direct Deposit Form Example - Page 2

What is Direct deposit form example?

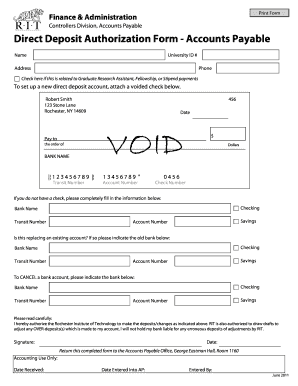

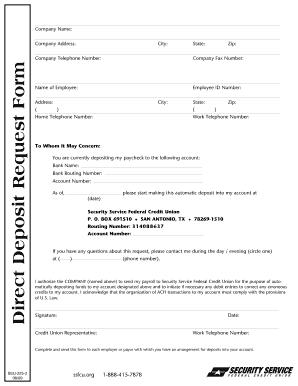

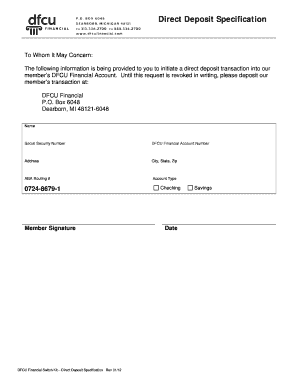

A Direct deposit form example is a document that allows an individual to authorize their employer to deposit their salary directly into their bank account. This eliminates the need for physical paychecks and enables seamless electronic payment.

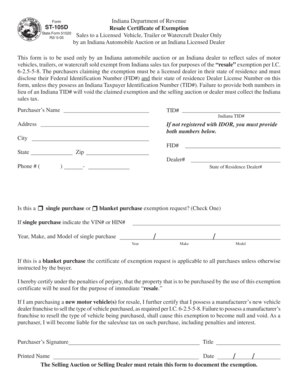

What are the types of Direct deposit form example?

There are several types of Direct deposit form examples, including: 1. Standard Direct Deposit Form 2. Automatic Transfer Authorization Form 3. Payroll Direct Deposit Form 4. Vendor Direct Deposit Form

Standard Direct Deposit Form

Automatic Transfer Authorization Form

Payroll Direct Deposit Form

Vendor Direct Deposit Form

How to complete Direct deposit form example

Completing a Direct deposit form example is simple and can be done by following these steps:

01

Fill in your personal information such as name, address, and social security number

02

Provide your bank account details including account number and routing number

03

Sign and date the form to authorize direct deposit

04

Submit the completed form to your employer for processing

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Direct deposit form example

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How can I direct deposit myself?

Here's everything you need to know about how to set up direct deposit at your financial institution. Get a direct deposit form from your employer. Ask for a written or online direct deposit form. Fill in account information. Confirm the deposit amount. Attach a voided check or deposit slip, if required. Submit the form.

What is an example of a bank direct deposit authorization form?

I hereby authorize [Company Name] to directly deposit my pay in the bank account(s) listed below in the percentages specified. (If two accounts are designated, deposits are to be made in whole percentages of pay to total 100%.)

Is Zelle the same as direct deposit?

Direct deposits (an ACH credit often used for payroll) and automatic recurring payments (ACH debits for services like utilities) are common examples of ACH payments. Are ACH and Zelle the same? No, ACH and Zelle are not technically the same thing, although Zelle utilizes the ACH network.

What is an example of a direct deposit?

Payroll payments are an example of direct deposits. Employers can send funds to their employees' bank accounts on payday without delay or the risk of losing checks in the mail. Recipients also benefit from direct deposits, as the money is automatically added to their account balance with no action required.

What things count as direct deposit?

Direct deposit is most commonly used to transfer an employee's salary. however, it may also be used for things like tax refunds, investment dividends, retirement account payments, and government benefits like Social Security or unemployment payments.

What form does my employer need for direct deposit?

A direct deposit authorization form authorizes a third party, usually an employer for payroll, to send money to a bank account.