What is Direct deposit policy samples?

Direct deposit policy samples are standard templates used by companies to outline their policies and procedures regarding direct deposit of employee salaries. These samples serve as a guide for both employers and employees to ensure a smooth payroll process.

What are the types of Direct deposit policy samples?

There are various types of direct deposit policy samples based on the specific requirements of different organizations. Some commonly used types include:

Standard Direct Deposit Policy Sample

Flexible Direct Deposit Policy Sample

Mandatory Direct Deposit Policy Sample

How to complete Direct deposit policy samples

Completing direct deposit policy samples is a simple process that involves the following steps:

01

Review the template and ensure it aligns with your company's policies

02

Customize the sample by filling in relevant details such as company name, employee details, and deposit preferences

03

Seek approval from relevant stakeholders before finalizing the policy

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Direct deposit policy samples

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Does Zelle payments count as direct deposit?

Your direct deposit needs to be an electronic deposit of your paycheck, pension or government benefits (such as Social Security) from your employer or the government. Person to Person payments (such as Zelle®) are not considered a direct deposit.

What is direct deposit rule?

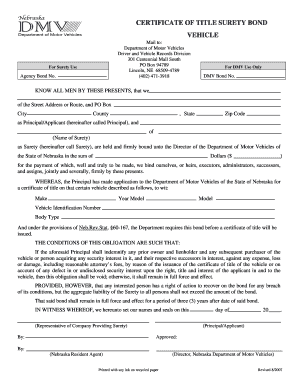

Direct deposit of a paycheck into a bank or other financial institution is permitted, but employers may not require it. Employees who authorize direct deposit designate their own financial institutions. employers may not designate a particular financial institution for exclusive payment of wages.

How to do direct deposit for employees?

Steps on How to Set Up Direct Deposit for Your Employees Decide on a payroll provider. If you don't have one set up already, you'll need a payroll provider that offers direct deposit services. Connect with your bank. Collect information from your employees. Create a payroll schedule. Run payroll.

What is an example of direct deposit description?

Payroll payments are an example of direct deposits. Employers can send funds to their employees' bank accounts on payday without delay or the risk of losing checks in the mail. Recipients also benefit from direct deposits, as the money is automatically added to their account balance with no action required.

What qualifies for direct deposit?

Direct deposits include deposits made by the customer's employer issuing payroll or a federal or state government agency paying benefits, etc. Direct deposits do not include deposits to an account that are made by an individual using online/mobile banking or an Internet payment provider such as PayPal.

How do you write a direct deposit?

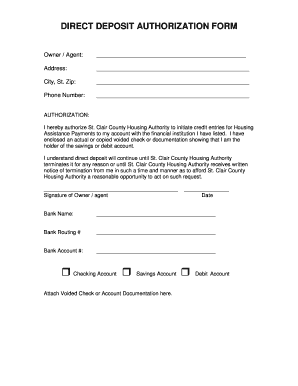

Each employee needs to provide the following information: bank name, account type, account number and routing number. Some states also require employees to sign a consent form before their employer can switch them to direct deposit.