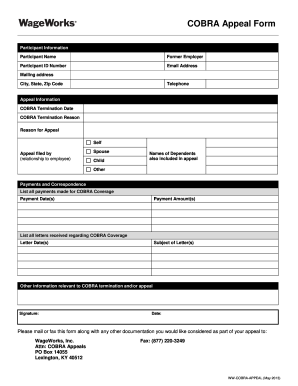

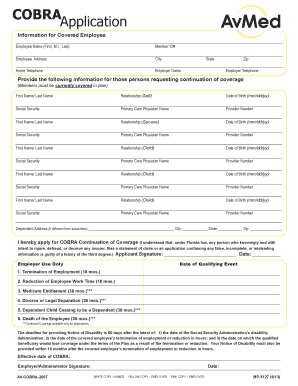

Cobra Application Form

What is Cobra application form?

A Cobra application form is a document used by individuals who are eligible for continuation coverage under the Consolidated Omnibus Budget Reconciliation Act (Cobra). This form allows individuals to enroll in a temporary health insurance plan after experiencing a qualifying event.

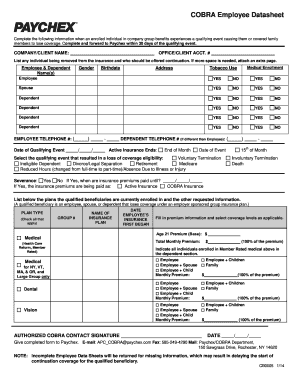

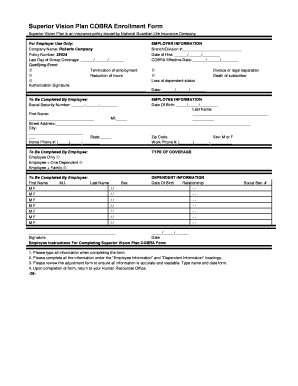

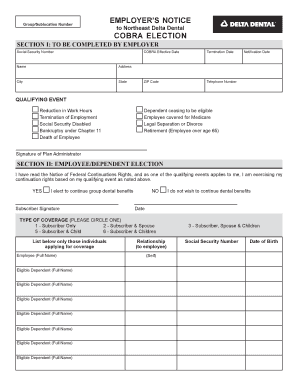

What are the types of Cobra application form?

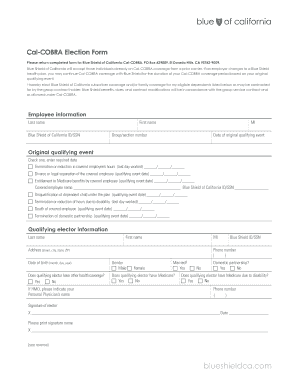

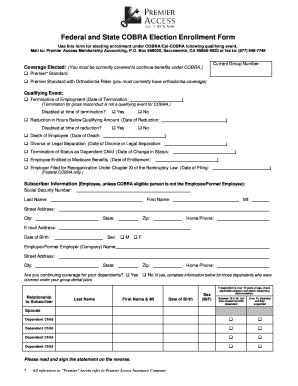

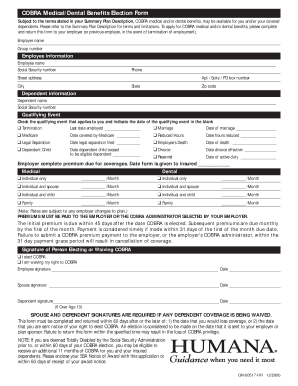

There are two main types of Cobra application forms: the initial notice and the election form.

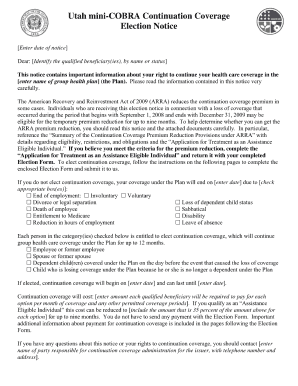

Initial notice form - This form is sent to individuals who are eligible for Cobra coverage, informing them of their rights and options to continue their health insurance.

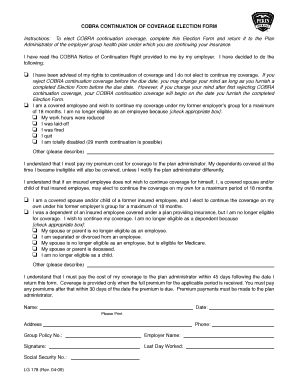

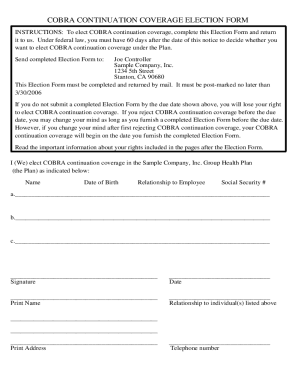

Election form - This form is used by individuals who have decided to enroll in Cobra coverage after receiving the initial notice.

How to complete Cobra application form

Completing a Cobra application form is a simple process that requires accurate information and attention to detail.

01

Gather all necessary personal information, including name, address, social security number, and qualifying event details.

02

Fill out the form completely and accurately, making sure to include all required information.

03

Double-check the form for any errors or missing information before submitting it.

04

Sign and date the form to confirm your enrollment in Cobra coverage.

05

Submit the form to the appropriate party within the specified deadline.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Cobra application form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

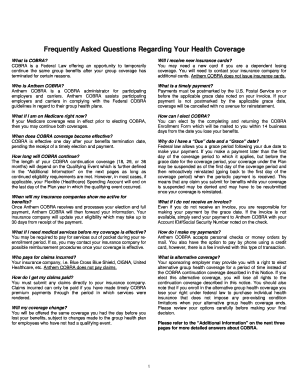

What is COBRA coverage and how does it work?

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss,

Can I get COBRA if I quit my job?

You have 60 days to enroll in COBRA once your employer-sponsored benefits end. You may even qualify if you quit your job or your hours were reduced. Other COBRA qualifying events include divorce from or death of the covered employee.

How does COBRA work when you quit?

COBRA coverage lets you pay to stay on your job-based health insurance for a limited time after your job ends (usually 18 months). You usually pay the full premium yourself, plus a small administrative fee.

How do I get COBRA after quitting?

How To Get COBRA After Losing Your Job Your former employer has up 45 days to send your COBRA continuing coverage election paperwork. The law requires your former employer to give you a 60 day open enrollment period to choose to continue your current work health plan or waive COBRA coverage.

Can I make my COBRA payment online?

You can make online payments with a credit or debit card, or from your checking or savings account. It takes two to three business days for payments to be processed, and they appear on card and bank statements as "Health Ins Premium Pmt."

What is COBRA form?

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss,