Cobra Termination Letter Due To Non-payment

What is Cobra termination letter due to non-payment?

A Cobra termination letter due to non-payment is a formal notice sent to individuals who have failed to pay their premiums for Cobra health insurance coverage. This letter informs the individual that their coverage will be terminated if payment is not received by a specified deadline.

What are the types of Cobra termination letter due to non-payment?

There are two main types of Cobra termination letters due to non-payment:

Initial Notice: This is the first letter sent to the individual informing them of the missed payment and the consequences if payment is not received.

Final Notice: This letter serves as a final warning before the termination of Cobra coverage. It typically includes a deadline for payment and information on how to appeal the decision.

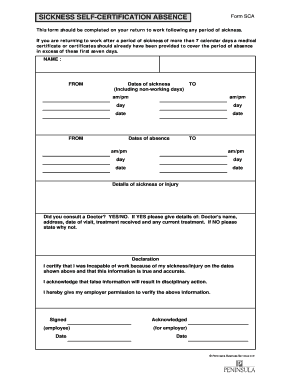

How to complete Cobra termination letter due to non-payment

To complete a Cobra termination letter due to non-payment, follow these steps:

01

Clearly state the reason for the letter and include the individual's name and contact information.

02

Provide details on the missed payments, including amounts owed and deadlines for payment.

03

Include information on how the individual can appeal the termination decision or make arrangements for payment.

04

Sign the letter and send it via certified mail to ensure delivery and proof of receipt.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Cobra termination letter due to non-payment

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I send a COBRA letter?

Employers should send notices by first-class mail, obtain a certificate of mailing from the post office, and keep a log of letters sent. Certified mailing should be avoided, as a returned receipt with no delivery acceptance signature proves the participant did not receive the required notice.

How do I get a COBRA termination letter?

When it's time to stop or cancel your coverage, you would need to make a request from the plan administrator to receive a letter of notice of COBRA termination. Typically, the COBRA Administrator is in the HR department or is a third-party administrator.

What penalties are available if an employer fails to comply with COBRA?

Plans that violate COBRA's provisions may be subject to a non-deductible excise tax penalty equal to $100 per day, per affected individual, per violation. In addition, ERISA provides notice penalties of up to $110 per day from the date of the compliance failure.

What happens if you elect COBRA but don't pay?

You can be required, however, to make an initial premium payment within 45 days after the date of your COBRA election (that is the date you mail in your election form, if you use first-class mail). Failure to make any payment within that period of time could cause you to lose all COBRA rights.

What are the rules for cancelling COBRA?

To cancel your COBRA plan you will need to notify your previous employer or the plan administrator in writing, requesting to terminate the insurance. The plan administrator is also who you've made your premium payments to.

Can COBRA be terminated for non payment?

If you fail to make any payment before the end of the initial 45-day period, the plan can terminate your COBRA rights. The plan should set due dates for any subsequent premium payments, but it must provide a minimum 30-day grace period for each payment.