Cobra Employer Changes Plan

What is Cobra employer changes plan?

The Cobra employer changes plan allows employees who lose their job or have a reduction in hours to continue their existing health insurance coverage for a limited period. This can provide peace of mind and ensure that individuals and their families have access to necessary medical care during times of transition.

What are the types of Cobra employer changes plan?

There are two main types of Cobra employer changes plan: 1. The standard Cobra plan, which allows employees to continue their current health insurance coverage but at a higher cost, as they are now responsible for paying the full premium. 2. The state continuation plan, which may be available in some states and allows employees of smaller companies to continue their coverage under similar terms as the standard Cobra plan.

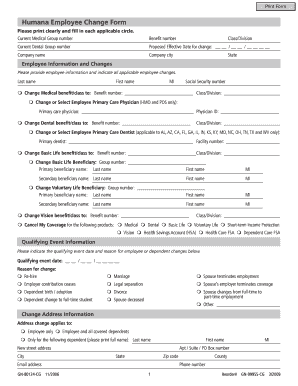

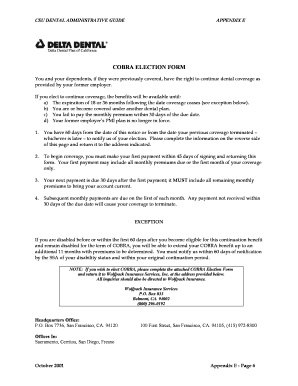

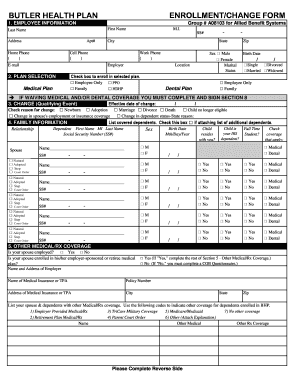

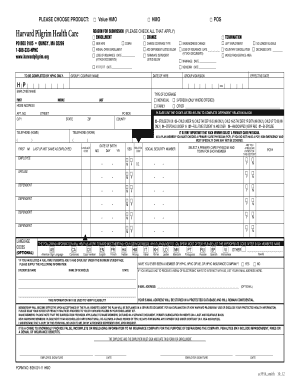

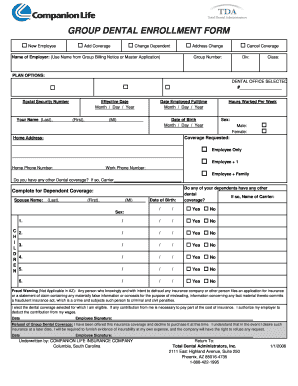

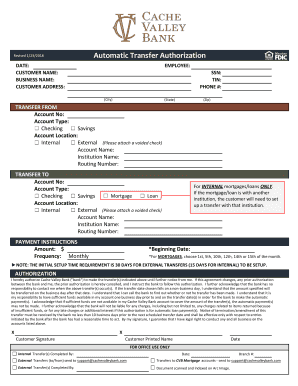

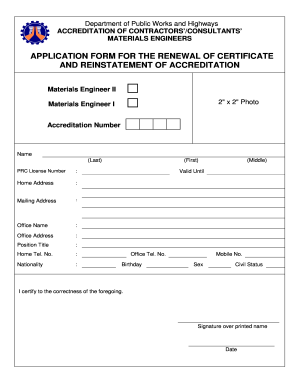

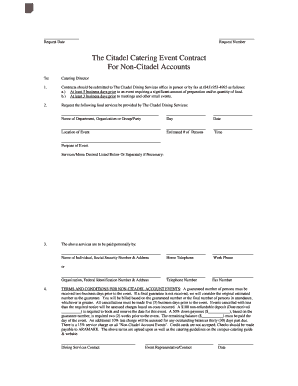

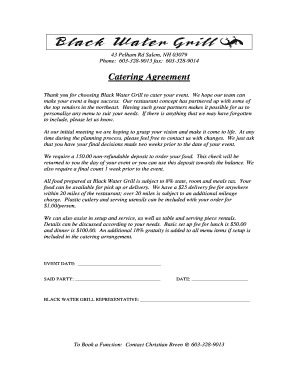

How to complete Cobra employer changes plan

Completing the Cobra employer changes plan is a relatively straightforward process. Here are some steps to guide you through: 1. Notify your employer of your eligibility for Cobra coverage. 2. Complete the necessary forms and paperwork provided by your employer. 3. Make premium payments to maintain your coverage. 4. Keep records of all communications and transactions related to your Cobra plan to ensure seamless continuation of coverage.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.