Health Insurance Coverage Questionnaire

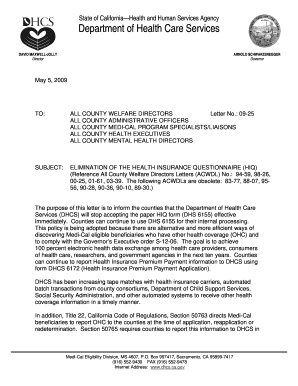

What is Health insurance coverage questionnaire?

A Health insurance coverage questionnaire is a form used by insurance companies to gather information about an individual's health status, medical history, and any pre-existing conditions. This information helps the insurance company assess the risk of insuring the individual and determine the cost of coverage.

What are the types of Health insurance coverage questionnaire?

There are several types of Health insurance coverage questionnaires, including but not limited to:

General health questionnaire

Medical history questionnaire

Pre-existing conditions questionnaire

Family medical history questionnaire

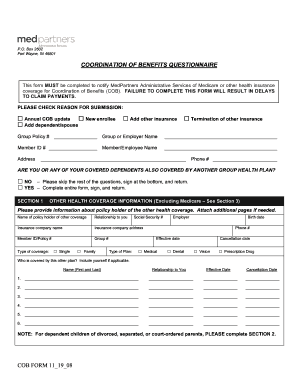

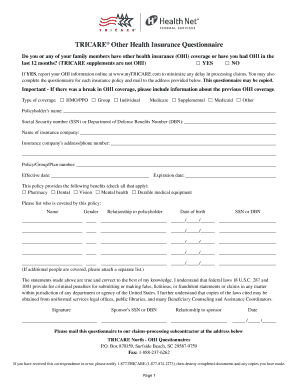

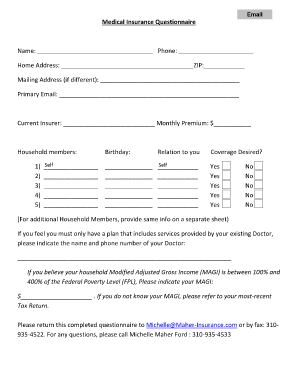

How to complete Health insurance coverage questionnaire

To complete a Health insurance coverage questionnaire, follow these steps:

01

Carefully read each question and provide accurate information.

02

Consult with your healthcare provider if you are unsure about any medical details.

03

Be honest and transparent in your responses to ensure proper coverage and avoid any potential issues in the future.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Health insurance coverage questionnaire

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the 5 basic parts of health insurance?

As an insurance client, it's important to understand the five basic components when looking at health insurance. These include premiums, deductibles, co-payments, coinsurance, and out-of-pocket maximums.

What are the 5 most important components of an insurance plan?

Every insurance policy has five parts: declarations, insuring agreements, definitions, exclusions and conditions. Many policies contain a sixth part: endorsements. Use these sections as guideposts in reviewing the policies. Examine each part to identify its key provisions and requirements.

What are the main components of insurance?

The core components that make up most insurance policies are the premium, deductible, and policy limits.

What are some of the questions one needs to ask when evaluating health insurance coverage?

Related questions to ask: How much will I pay each month (monthly premium)? How much will I pay to see my doctor, visit urgent care, go to the emergency room or fill prescriptions (copays)? If I get the same care as last year, what would it cost? Does the bottom line fit my budget?

What are three things you should ask about when choosing a health insurance plan?

Here's a list of ten questions you should ask before picking a health care plan. 1: What Type of Plan Is It? 2: How Much Will I Have to Pay for Medical Care? 3: Will I Be Able to Use My Current Doctors?

What are the key factors of the health insurance system?

Five factors can affect a plan's monthly premium: location, age, tobacco use, plan category, and whether the plan covers dependents. Notice: FYI Your health, medical history, or gender can't affect your premium.