Sample Letter Requesting Certificate Of Insurance From Vendors

What is Sample letter requesting certificate of insurance from vendors?

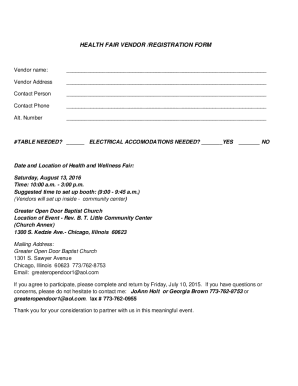

A sample letter requesting a certificate of insurance from vendors is a formal document that serves as proof of insurance coverage held by a vendor. This letter is used to verify that the vendor has adequate insurance to protect against potential risks and liabilities.

What are the types of Sample letter requesting certificate of insurance from vendors?

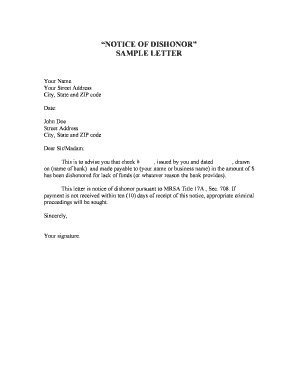

There are several types of sample letters that can be used to request a certificate of insurance from vendors. These include general request letters, specific coverage requirement letters, and follow-up letters to ensure compliance with insurance obligations.

How to complete Sample letter requesting certificate of insurance from vendors

To complete a sample letter requesting a certificate of insurance from vendors, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.