Insurance Certificate Request Form Templates

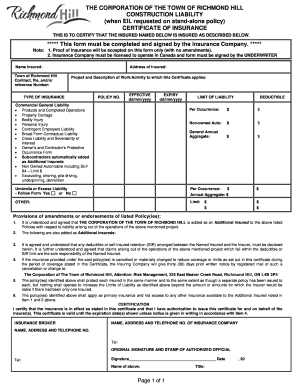

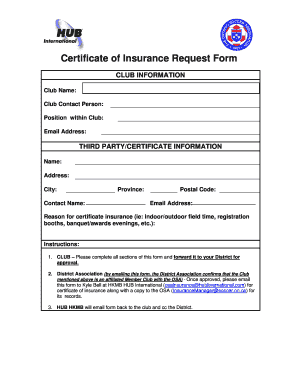

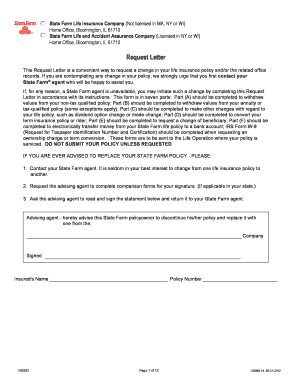

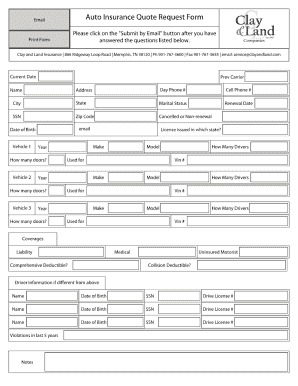

What are Insurance Certificate Request Form Templates?

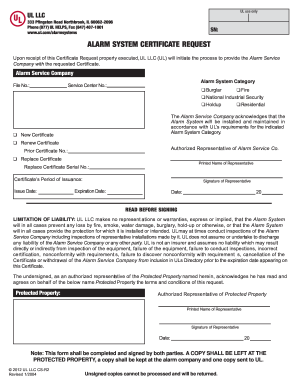

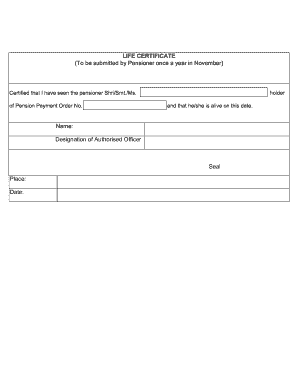

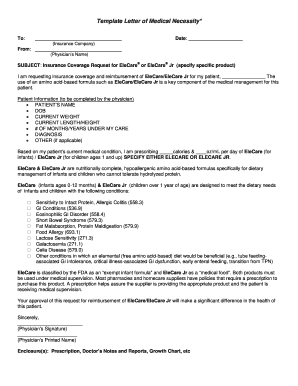

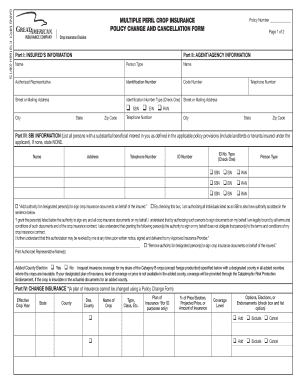

Insurance Certificate Request Form Templates are pre-designed forms used by individuals or businesses to request insurance certificates from insurance providers. These templates streamline the process by providing a structured format for requesting the necessary information.

What are the types of Insurance Certificate Request Form Templates?

There are several types of Insurance Certificate Request Form Templates available, including: 1. General Liability Insurance Certificate Request Form 2. Auto Insurance Certificate Request Form 3. Property Insurance Certificate Request Form 4. Workers' Compensation Insurance Certificate Request Form 5. Professional Liability Insurance Certificate Request Form

How to complete Insurance Certificate Request Form Templates

Completing Insurance Certificate Request Form Templates is simple and straightforward. Follow these steps to ensure you provide all the necessary information:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.