Sample Insurance Waiver Form

What is Sample insurance waiver form?

A Sample insurance waiver form is a legal document that waives the right to claim specified insurance benefits. It is typically used in situations where individuals voluntarily participate in activities that carry inherent risks, such as sports or events.

What are the types of Sample insurance waiver form?

There are several types of Sample insurance waiver forms, including:

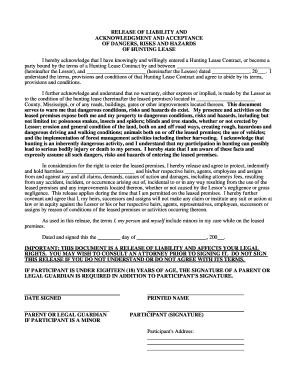

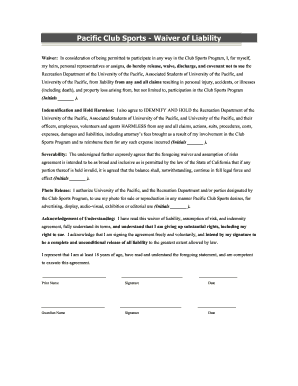

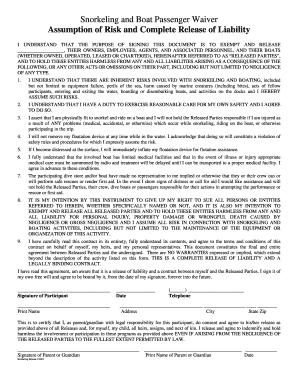

General liability waiver form

Medical release waiver form

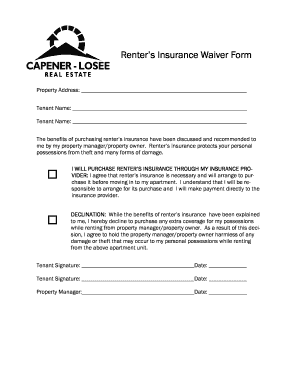

Property damage waiver form

Personal injury waiver form

How to complete Sample insurance waiver form

Completing a Sample insurance waiver form is easy and straightforward. Here are the steps to follow:

01

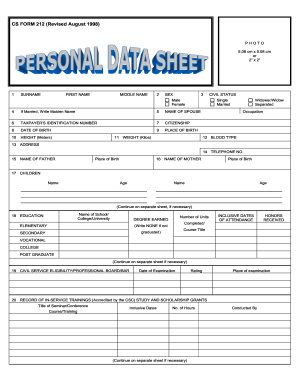

Fill in your personal information, including name, address, and contact details.

02

Read the terms and conditions carefully before signing the form.

03

Date the form and sign it to indicate your agreement to waive the specified insurance benefits.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Sample insurance waiver form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can I create my own liability waiver?

Writing a liability waiver is something that should not be taken lightly. Snagging a template online and calling it good could spell financial ruin for your organization. The small investment in legal help from someone who specializes in the field of liability waivers may pay dividends for years.

What should be included in a waiver form?

10 Things to Include in a Liability Waiver Business Information. Detailed Description of the Activity. Inherent Risks of the Activity. Acknowledgement and Voluntary Assumption of Risk. Choice of Law Provision Section. Release Clause. Indemnification Clause. Forum Selection or Venue Clause.

What makes a waiver legally binding?

A liability waiver becomes a binding legal document once signed. This means the signatory: Is informed about potential risks involved in participating in an activity. Agrees not to sue the company issuing the waiver in case of a stipulated event or occurrence.

Can you create your own waiver?

Writing a waiver should not be complicated. However, it is important to consult a lawyer when you have any questions so as to have an effective waiver at the end of the day. You may call your state legal person if you are not able to reach a lawyer. You may also seek the advice of a lawyer after drafting the waiver.

What is a valid waiver in insurance?

Examples of valid waiver reasons accepted by most carriers include: Other group coverage through a different employer. Other group coverage through a spouse or parent. Enrolling as a dependent in your employer's group health plan. Coverage through Medicare.

What makes a good waiver?

Activity risks: The waiver should describe in detail the risks surrounding the activity or service provided by your company. The participant must be made fully informed of potential risks before they can take part in the activity. They must also be made aware that your company will not cover their insurance costs.