Insurance Waiver Form For Contractors

What is Insurance waiver form for contractors?

An Insurance waiver form for contractors is a document that contractors may be required to sign to waive certain insurance requirements specified in a contract. It allows contractors to proceed with the work without having to carry certain types of insurance coverage.

What are the types of Insurance waiver form for contractors?

There are several types of Insurance waiver forms for contractors, including:

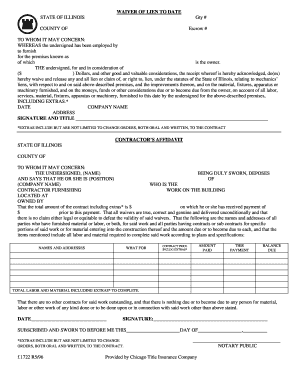

Liability Insurance Waiver Form

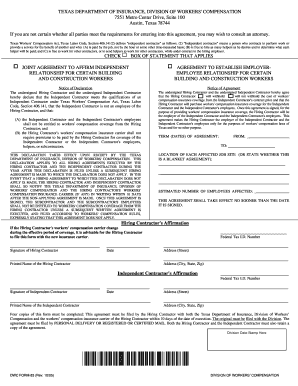

Workers' Compensation Insurance Waiver Form

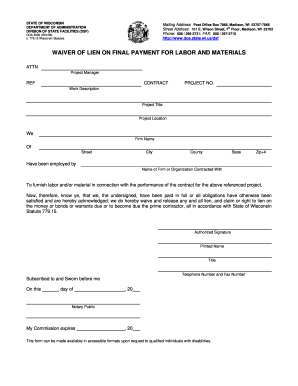

Property Insurance Waiver Form

Auto Insurance Waiver Form

How to complete Insurance waiver form for contractors

Completing an Insurance waiver form for contractors is a simple process. Here are the steps:

01

Fill in your personal information, including name, contact information, and contractor's license number.

02

Specify the type of insurance coverage you are waiving in the form.

03

Sign and date the form to acknowledge your agreement to waive the specified insurance coverage.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Insurance waiver form for contractors

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Do liability waivers actually work?

For the most part, the signing of a waiver is going to hold up in court as a binding document. That does not mean, however, that you are out of options if you sign a release of liability waiver and then sustain an injury while participating in the activity the business offered.

How do I write a liability waiver?

When creating a waiver form, there are a few key elements that you will need to include: The name of the business and the event. A description of the risks involved in the event. A release of liability statement. The signature of the customer or participant.

What are the benefits of a liability waiver?

The most significant reason to use a liability waiver is that businesses can protect themselves from damages claims and lawsuits associated with inherently risky activities. This level of protection can shield your profitability and company reputation as well as avoid unnecessary legal disputes.

What is the meaning of waiver of liability?

A liability waiver is a legal document that a person who participates in an activity may sign to acknowledge the risks involved in their participation. By doing so, the company attempts to remove legal liability from the business or person responsible for the activity.

What is a liability waiver form?

A liability waiver form is a legal contract that educates one party about the risks associated with an activity. Once signed, it prevents the participant from opening a lawsuit against the company in the event of damage or loss, effectively shifting responsibility for injuries from the company to the customer.

What is another term for liability waiver?

When the right to hold a person liable through a lawsuit are waived, the waiver may be called an exculpatory clause, liability waiver, legal release, or hold harmless clause.