Insurance Appeal Letter Sample - Page 2

What is Insurance appeal letter sample?

An insurance appeal letter sample is a formal written communique that an individual can send to their insurance company to contest a decision made by the insurer. This letter is used to ask the insurance company to reconsider their decision regarding coverage, claims, or denied services.

What are the types of Insurance appeal letter sample?

There are several types of insurance appeal letter samples that can be used based on the specific situation. Some common types include:

Medical insurance appeal letter sample

Auto insurance appeal letter sample

Home insurance appeal letter sample

Life insurance appeal letter sample

How to complete Insurance appeal letter sample

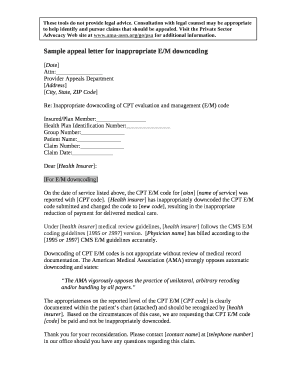

When completing an insurance appeal letter sample, it is essential to include the following information:

01

Personal information: Name, address, contact information

02

Policy details: Policy number, type of coverage

03

Reason for appeal: Clearly state the reason for the appeal

04

Supporting documents: Include any relevant medical records, bills, or other documentation

05

Request for action: Clearly state what action you are requesting from the insurance company

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Insurance appeal letter sample

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I start an appeal letter for insurance?

My name is [patient] and I am a policyholder of [insurance company]. I wish to file an appeal concerning [insurance company name's] denial of a claim for [procedure name]. I received an Explanation of Benefits dated [provide date] stating [provide denial reason directly from letter].

How successful are insurance appeals?

The potential of having your appeal approved is the most compelling reason for pursuing it—more than 50 percent of appeals of denials for coverage or reimbursement are ultimately successful. This percentage could be even higher if you have an employer plan that is self-insured.

What are appeals in insurance?

A request for your health insurance company or the Health Insurance Marketplace ® to review a decision that denies a benefit or payment.

How do I write an appeal letter for insurance?

How to write an appeal letter to insurance company appeals departments Step 1: Gather Relevant Information. Step 2: Organize Your Information. Step 3: Write a Polite and Professional Letter. Step 4: Include Supporting Documentation. Step 5: Explain the Error or Omission. Step 6: Request a Review. Step 7: Conclude the Letter.

How do I make a successful insurance appeal?

Things to Include in Your Appeal Letter Patient name, policy number, and policy holder name. Accurate contact information for patient and policy holder. Date of denial letter, specifics on what was denied, and cited reason for denial. Doctor or medical provider's name and contact information.

What are possible solutions to a denied claim?

Appeal the denial If you believe that the insurance company's decision was incorrect, you can file an appeal. This may involve submitting a written request to the insurance company explaining why you believe the claim should be approved. You may also be able to present your case to an independent review board.