Home Insurance Template

What is Home insurance template?

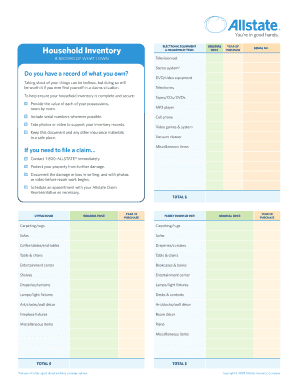

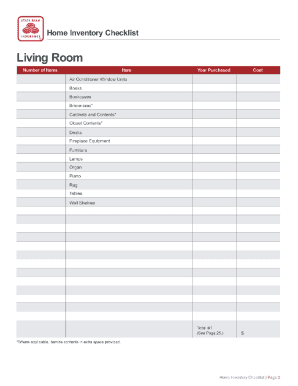

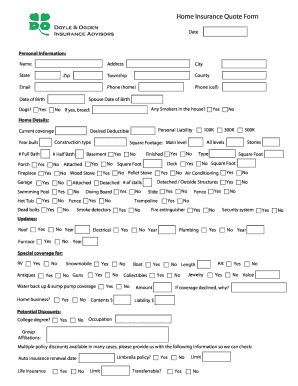

A Home insurance template is a document that outlines the terms and conditions of a home insurance policy. It typically includes details such as coverage limits, deductibles, and exclusions.

What are the types of Home insurance template?

There are several types of Home insurance templates available to suit different needs and budgets. Some common types include:

Basic Home insurance template - provides essential coverage for home and personal property.

Comprehensive Home insurance template - offers broader coverage including protection against natural disasters and liability claims.

Condo insurance template - specifically designed for condo owners, covering the interior of the unit and personal belongings.

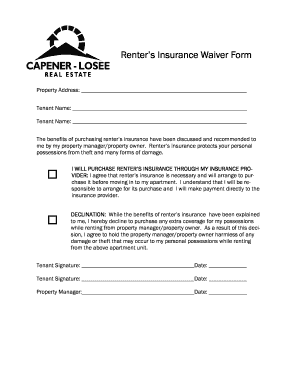

Renter's insurance template - protects the belongings of renters and provides liability coverage for accidents within the rental property.

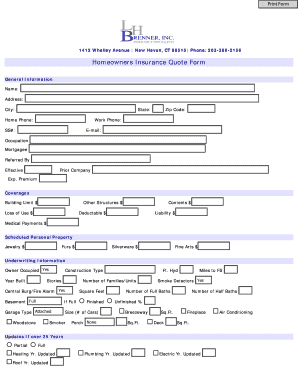

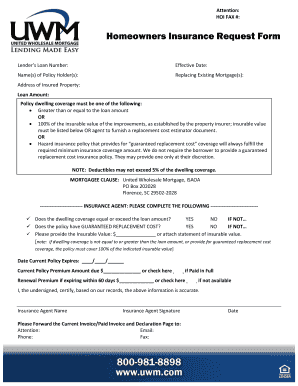

How to complete Home insurance template

Completing a Home insurance template is easy with the right tools and resources. Here are the steps to follow:

01

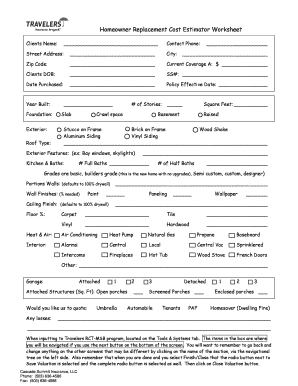

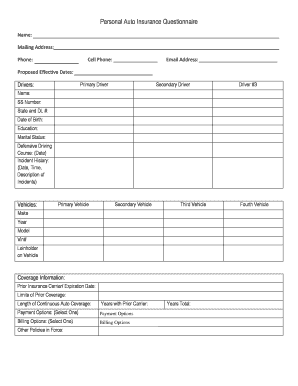

Gather necessary information such as property details, personal information, and desired coverage limits.

02

Fill in the required fields of the template with accurate information.

03

Review the completed template for any errors or missing information.

04

Save the document in a secure location for future reference and sharing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.

Video Tutorial How to Fill Out Home insurance template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the difference between HO3 and ho5?

The difference between the two is the coverage for your personal property. This includes everything from your clothing and electronics to your curtains and furniture. HO-3 policies only cover personal property for named perils. If you want open perils coverage for your belongings, you will need an HO-5 policy.

How many quotes should you get for insurance?

So many insurance quotes are available online, but how many quotes do you need to compare? We recommend comparing at least five insurance quotes before making a decision. However, before you pick the policy with the lowest premium rate, there are several other factors you need to consider.

Should I get multiple quotes for homeowners insurance?

The best way to lower your home insurance costs is to compare quotes among insurance companies. Not all insurers price their policies the same, so make sure you get quotes from multiple insurers so you can see a range of prices. You can also ask about home insurance discounts.

What is the most common homeowners insurance form?

The HO-3, also known as a "special form," is the most common homeowners insurance policy form, says the National Association of Insurance Commissioners. An HO-3 offers "open peril" coverage for the structure of your home.

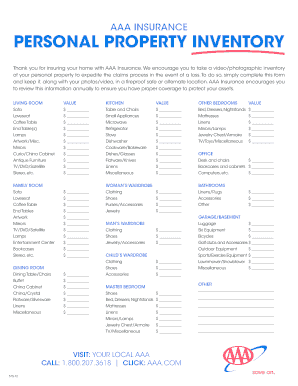

What should be included in homeowners insurance?

Standard Homeowners Insurance Coverage. A standard homeowners insurance policy provides coverage to repair or replace your home and its contents in the event of damage. That usually includes damage resulting from fire, smoke, theft or vandalism, or damage caused by a weather event such as lightning, wind, or hail.

What are 2 things not covered in homeowners insurance?

Many things that aren't covered under your standard policy typically result from neglect and a failure to properly maintain the property. Termites and insect damage, bird or rodent damage, rust, rot, mold, and general wear and tear are not covered.