1095-a Form 2019

What is 1095-a form 2019?

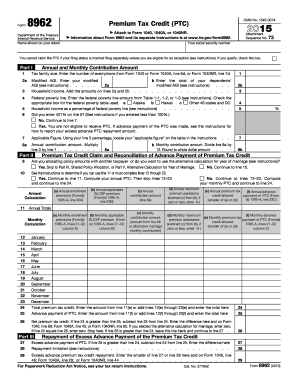

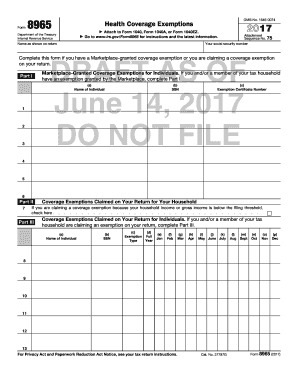

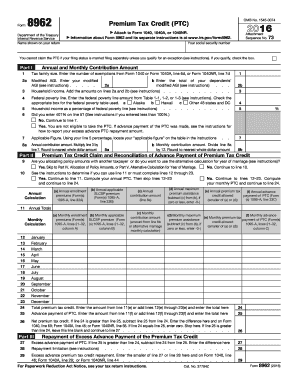

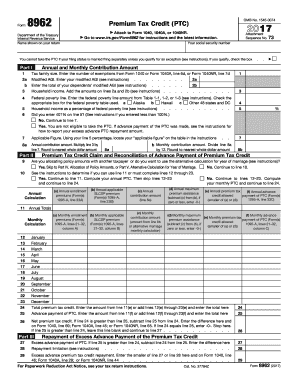

The 1095-A form for 2019 is a Health Insurance Marketplace Statement. It provides information about your health coverage if you or someone in your household enrolled in a Marketplace plan. The form is important for filing your taxes and determining if you qualify for a premium tax credit.

What are the types of 1095-a form 2019?

There are two main types of 1095-A forms for 2019:

Form 1095-A for individuals who enrolled in a Marketplace plan

Form 1095-A for families who enrolled in a Marketplace plan

How to complete 1095-a form 2019

Completing the 1095-A form for 2019 is essential for accurate tax filing. Here are some steps to help you complete the form:

01

Review the information on the form to ensure accuracy

02

Enter any changes to your household or coverage details

03

Make sure to include all members of your household who were covered by the plan

04

Submit the form by the deadline to the IRS and keep a copy for your records

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 1095-a form 2019

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

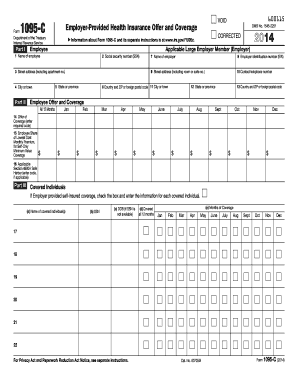

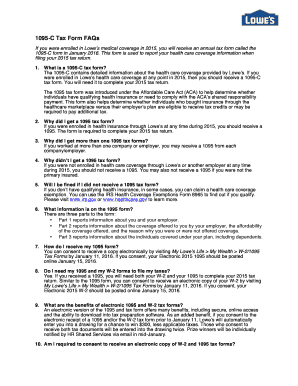

Are 1095 forms mandatory?

Form 1095-B is not required to file your state or federal taxes and you may self‑attest to your health coverage without it. You should get a Form 1095-B in the mail by January 31 following the reported tax year.

Where can I download my 1095-A form?

They can also log into their account on an approved primary Enhanced Direct Enrollment (EDE) entity's website to retrieve their Form 1095-A or download a copy from their “My Account” page on HealthCare.gov.

Are 1095 forms required for 2019?

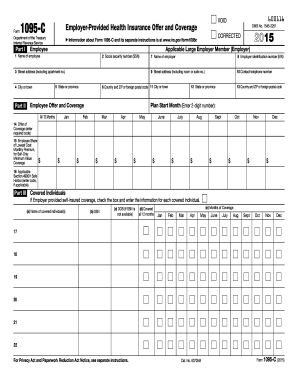

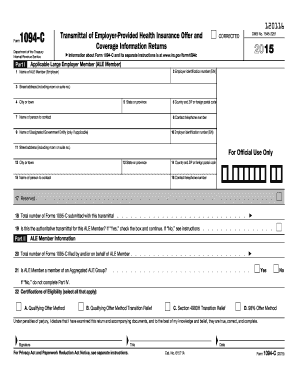

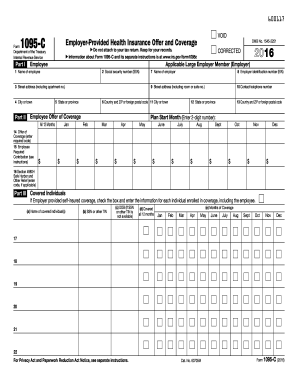

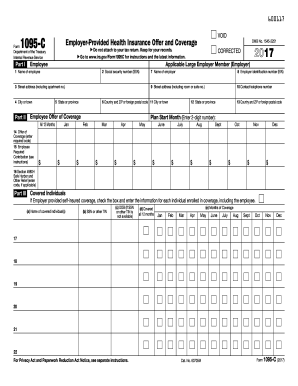

For calendar year 2019, Forms 1094-C and 1095-C are required to be filed by February 28, 2020, or March 31, 2020, if filing electronically. See Furnishing Forms 1095-C to Employees for information on when Form 1095-C must be furnished.

When did 1095 become required?

Sending out 1095-C forms became mandatory starting with the 2015 tax year. Employers send the forms not only to their eligible employees but also to the IRS. Employees are supposed to receive them by the end of January—so forms for 2022 would be sent in January 2023.

What happens if I don't enter my 1095?

What happens if you don't file your 1095-A? You will not be able to file your taxes without Form 1095-A. You can wait on your form to arrive in the mail or log into your HealthCare.gov account to find your form. If you filed your taxes before reviewing Form 1095-A, you may need to submit an amended tax return.

How do I get my 1095-A form 2019?

By Jan. 31 of each year, Covered California sends the federal IRS form 1095-A Health Insurance Marketplace statement to members. This form is used to: Provide information for your federal taxes.