Health Insurance Cancellation Letter

What is a Health Insurance Cancellation Letter?

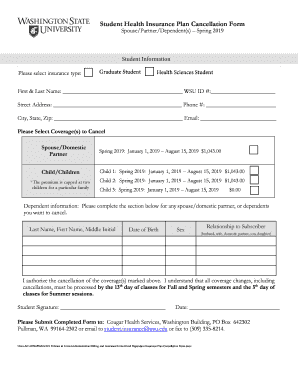

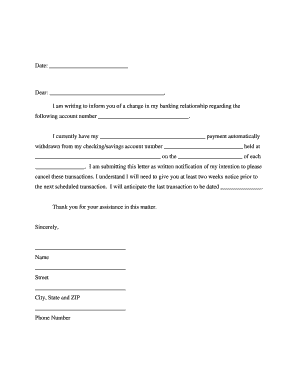

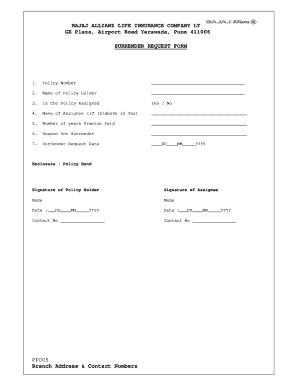

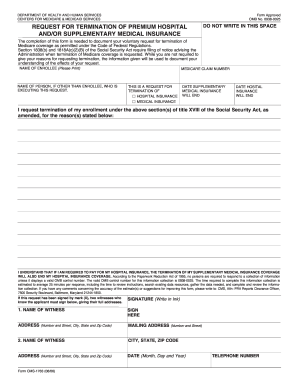

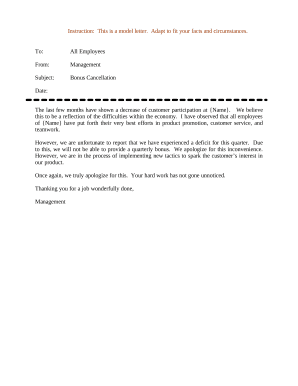

A Health Insurance Cancellation Letter is a formal document sent to your insurance provider to request the termination of your health insurance policy. It outlines your decision to end the coverage and includes important details such as your policy number and effective date of cancellation.

What are the types of Health Insurance Cancellation Letter?

There are two main types of Health Insurance Cancellation Letters: voluntary cancellation letter and non-renewal cancellation letter. Voluntary cancellation letters are used when you decide to terminate your policy, while non-renewal letters are sent by the insurance company when they choose not to renew your policy.

How to complete a Health Insurance Cancellation Letter

Completing a Health Insurance Cancellation Letter is a straightforward process. Follow these steps to ensure that your letter is accurate and includes all necessary information:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.