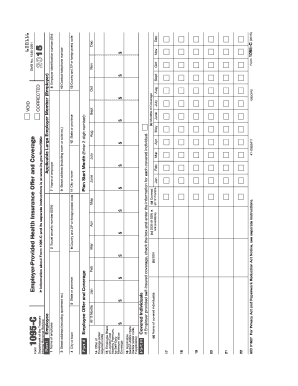

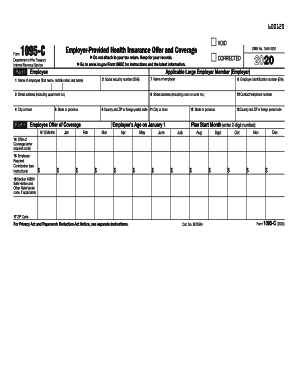

Www Irs Gov Form 1095-b En Español

What is Www irs gov form 1095-b en español?

Www irs gov form 1095-b en español is a tax form provided by the IRS that reports information about your health coverage throughout the year in Spanish. It is essential for individuals to understand and accurately complete this form to ensure compliance with the IRS regulations.

What are the types of Www irs gov form 1095-b en español?

There are different types of Www irs gov form 1095-b en español based on the source of your health coverage. The two main types include employer-provided coverage and coverage through a government program. Each type serves a specific purpose and requires different information to be accurately reported.

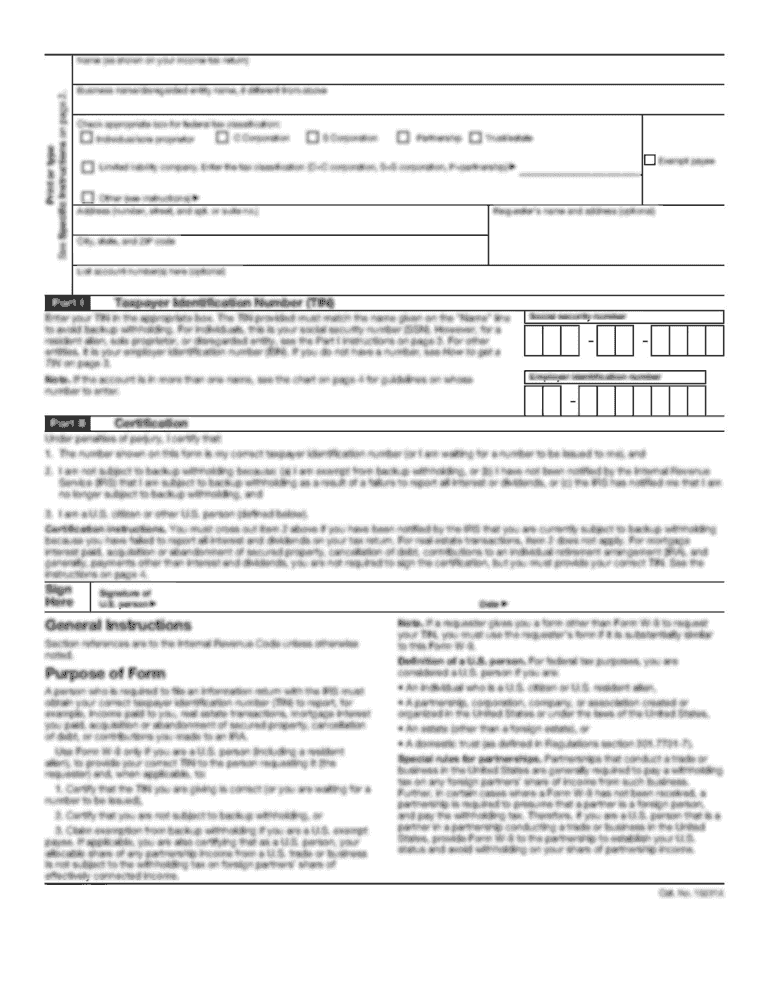

How to complete Www irs gov form 1095-b en español

Completing Www irs gov form 1095-b en español is a simple process that requires accurate information about your health coverage. Follow these steps to ensure you fill out the form correctly:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.