Car Insurance Cancellation Letter Pdf

What is Car insurance cancellation letter pdf?

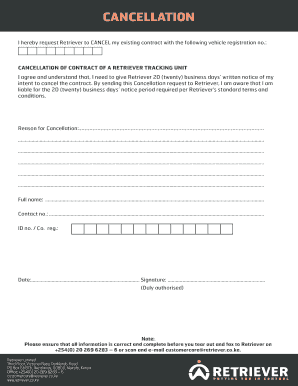

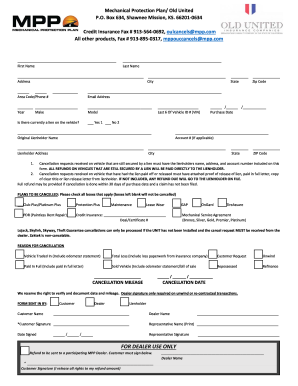

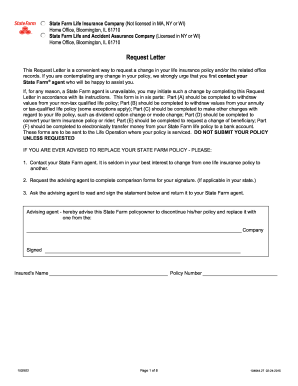

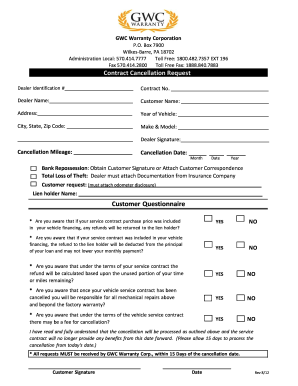

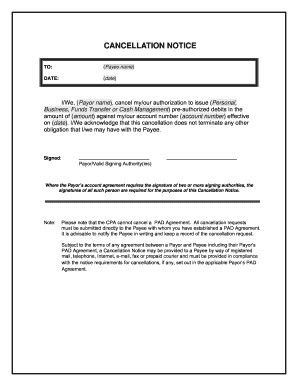

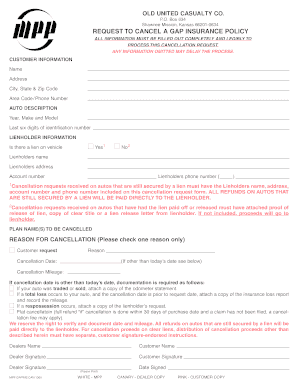

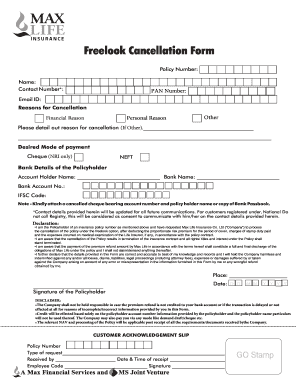

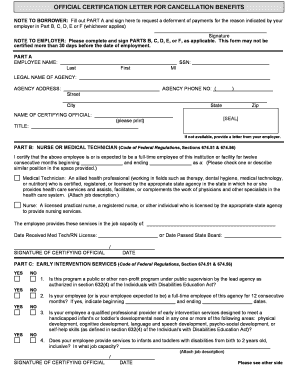

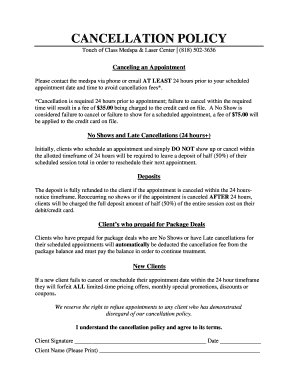

A Car insurance cancellation letter pdf is a document used to formally request the termination of an auto insurance policy in written form. It serves as a written record of the policyholder's intent to cancel their insurance coverage.

What are the types of Car insurance cancellation letter pdf?

There are two main types of Car insurance cancellation letters in PDF format: formal letters and informal letters. Formal letters are typically used when dealing with an insurance company directly, while informal letters may be used to inform other parties, such as a bank or leasing company, about the policy cancellation.

How to complete Car insurance cancellation letter pdf

Completing a Car insurance cancellation letter in PDF format is a simple process that involves providing the necessary details about the policyholder, the insurance policy being cancelled, and the reason for cancellation. Here are the steps to complete a Car insurance cancellation letter in PDF:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.