Car Insurance Cancellation Letter Pdf

What is Car insurance cancellation letter pdf?

A Car insurance cancellation letter pdf is a document used to officially terminate an existing car insurance policy. It is a written notification sent to the insurance provider stating the policyholder's intention to cancel their coverage.

What are the types of Car insurance cancellation letter pdf?

There are two main types of Car insurance cancellation letter pdf:

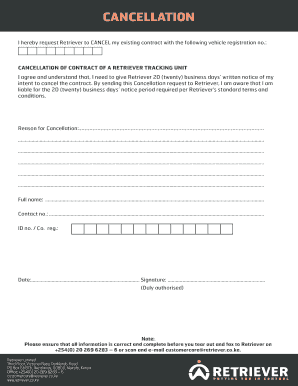

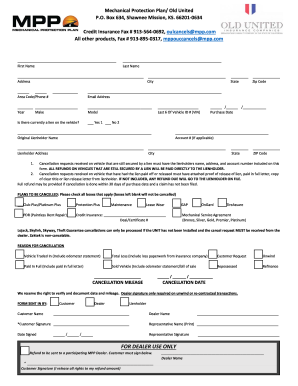

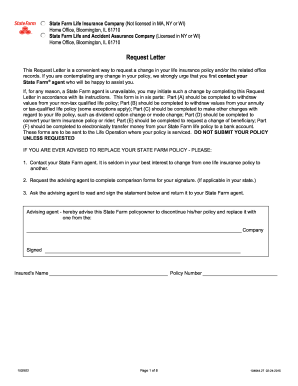

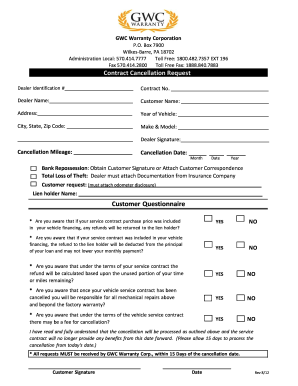

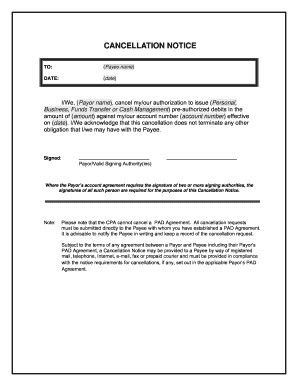

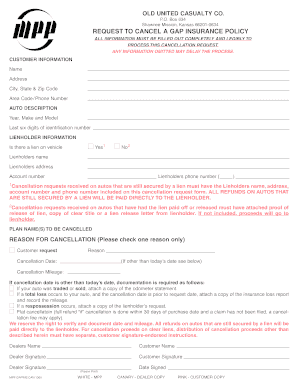

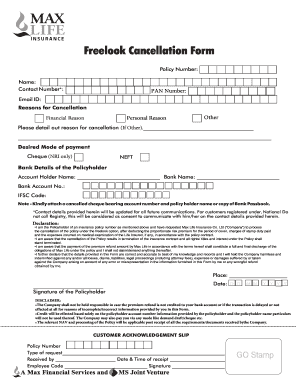

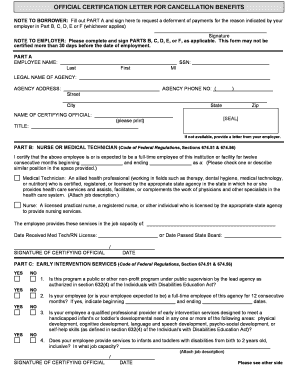

Standard Car insurance cancellation letter pdf - This type follows a general format and includes essential information such as policy number, effective date of cancellation, and reason for termination.

Formal Car insurance cancellation letter pdf - This type is more detailed and may require additional documentation or signatures, depending on the insurance company's specific requirements.

How to complete Car insurance cancellation letter pdf

To complete a Car insurance cancellation letter pdf, follow these steps:

01

Start by downloading a fillable Car insurance cancellation letter pdf template from a reputable source, such as pdfFiller.

02

Fill in your personal information and policy details, including your name, address, policy number, and effective date of cancellation.

03

Clearly state the reason for canceling your car insurance policy in a concise and professional manner.

04

Review the completed letter for accuracy and ensure all required information is included.

05

Save the document as a PDF file and send it to your insurance provider via email or mail.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Car insurance cancellation letter pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the best way to cancel an insurance policy?

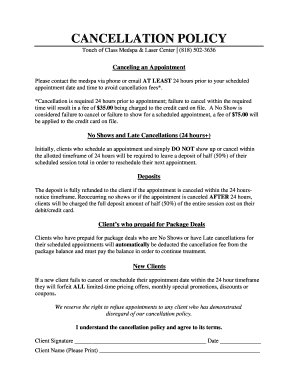

Contact your insurer or agent to find the best way to cancel your policy. Some insurance companies permit you to cancel right over the phone or online. Other insurers may require written notification or a signed document.

How to write a cancellation letter for car insurance policy?

To Whom It May Concern, I would like to request the prompt cancellation of my auto insurance policy, [policy number], effective [date new policy begins]. I will be covered by [new insurance company name], new policy number [new policy number]. Please stop automatic payments or debits from my account as of that Date.

What is the best way to cancel car insurance?

Contact your insurer or agent to find the best way to cancel your policy. Some insurance companies permit you to cancel right over the phone or online. Other insurers may require written notification or a signed document.

Is cancelling car insurance easy?

The easiest way to cancel your car insurance is to call your insurance company or agent. In many cases, a phone call is enough to cancel your policy or stop insurance renewal.

How do you write a cancellation policy for insurance?

Dear [Recipient's Name], I am writing this letter as a formal request to cancel my life insurance policy with your company. My policy number is [Policy no], and please make it effective from [mention date]. I further request that you cease all charges associated with the premium and return the payments made earlier.

Is it better to cancel car insurance or let it lapse?

You can cancel a car insurance policy at any time. You may even get a partial or full refund of any premiums you've prepaid. However, it's a good idea to do a little research before canceling your insurance to avoid consequences, such as a coverage lapse. A lapse can lead to increase premiums for you in the future.