Irs Health Insurance Form Templates - Page 4

What are Irs Health Insurance Form Templates?

Irs Health Insurance Form Templates are standardized forms provided by the Internal Revenue Service for individuals to report their health insurance coverage and any associated tax credits or penalties.

What are the types of Irs Health Insurance Form Templates?

There are several types of Irs Health Insurance Form Templates, including:

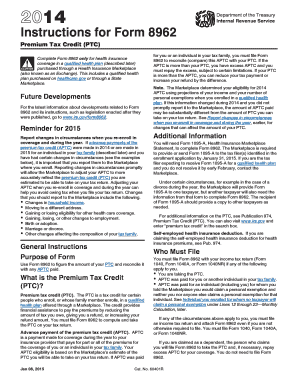

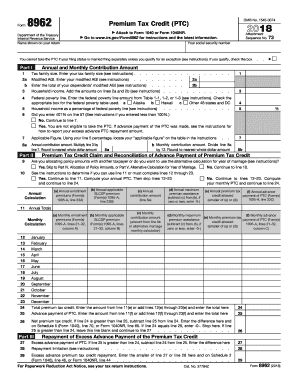

Form 1095-A: Health Insurance Marketplace Statement

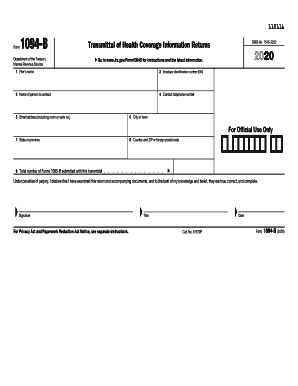

Form 1095-B: Health Coverage

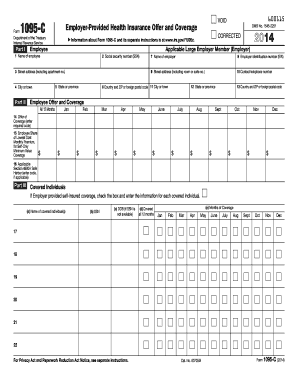

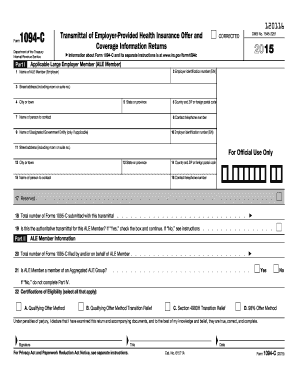

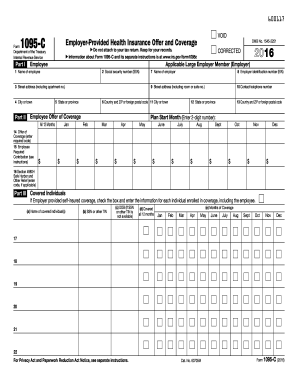

Form 1095-C: Employer-Provided Health Insurance Offer and Coverage

How to complete Irs Health Insurance Form Templates

Completing Irs Health Insurance Form Templates is a straightforward process. Follow these steps:

01

Gather all necessary information such as your health insurance policy details, tax information, and any relevant documents.

02

Carefully review the form instructions to ensure you fill out the form correctly.

03

Enter the required information accurately and double-check for any errors before submitting the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Irs Health Insurance Form Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the difference between a 1095-A and a 1095-B?

Form 1095-A: If you were covered by a plan through a federal or state marketplace (also called an exchange), you will receive this form from the marketplace. Form 1095-B: If you are enrolled in a fully-insured employer sponsored plan, you will receive this form from your insurance carrier.

What IRS form shows health coverage?

Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment.

What is a 1095-B used for?

Form 1095-B is used as proof of Minimum Essential Coverage (MEC) when filing your state and/or federal taxes. It should be kept with your other tax information in the event the Internal Revenue Service (IRS) or Franchise Tax Board (FTB) requires you to provide it as proof of your health care coverage.

Can I download my 1095-A form?

Log in to your HealthCare.gov account. Under "Your Existing Applications," select your 2022 application — not your 2023 application. Select “Tax Forms” from the menu on the left. Download all 1095-As shown on the screen.

What is the IRS form for health insurance coverage?

Form 1095-B, Health Coverage. Health insurance providers (for example, health insurance companies) send this form to individuals they cover, with information about who was covered and when. Form 1095-C, Employer-Provided Health Insurance Offer and Coverage.

Who must file IRS 1095?

A company is responsible for filing IRS Form 1095-B only if two conditions apply: It offers health coverage to its employees, and it is "self-insured." This means that the company itself pays its employees' medical bills, rather than an insurance company.