Inventory Adjustment Template

What is Inventory adjustment template?

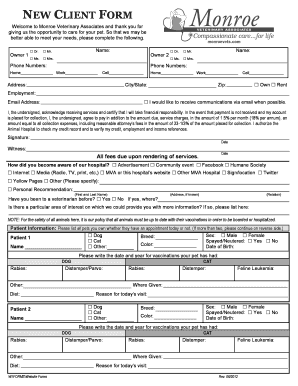

An Inventory adjustment template is a document used to record changes made to the inventory levels of a company. It helps in keeping track of the movement of goods and materials within the organization.

What are the types of Inventory adjustment template?

There are several types of Inventory adjustment templates that can be used based on the specific needs of the business. Some of the common types include:

Stock Revaluation Template

Stock Write-off Template

Stock Transfer Template

Stock Count Template

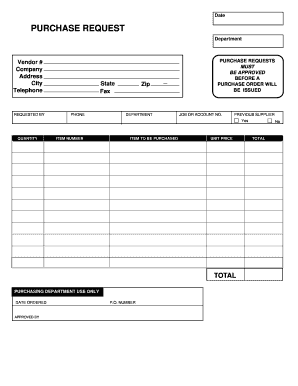

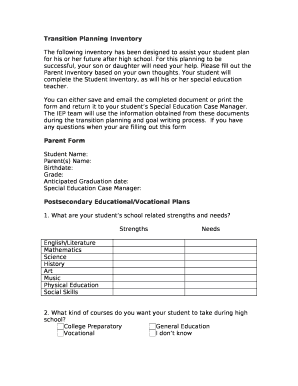

How to complete Inventory adjustment template

Completing an Inventory adjustment template is a straightforward process. Here are the steps to follow:

01

Enter the date of the adjustment

02

Specify the item or product being adjusted

03

Record the reason for the adjustment

04

Input the quantity of the adjustment

05

Update the total inventory count

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Inventory adjustment template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

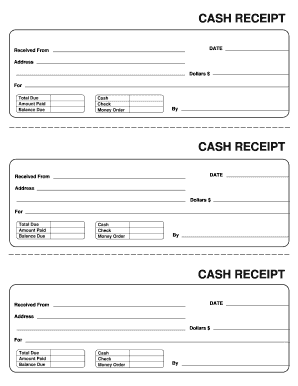

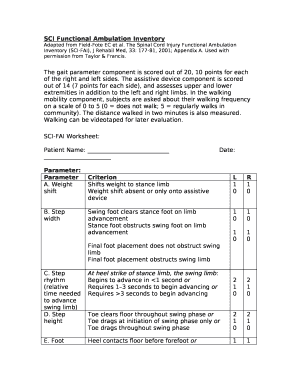

What are inventory adjustments?

Inventory adjustments are increases or decreases made in inventory to account for theft, loss, breakages, and errors in the amount or number of items received. Inventory adjustments are increases and decreases made to inventory to match an item's actual on-hand quantity.

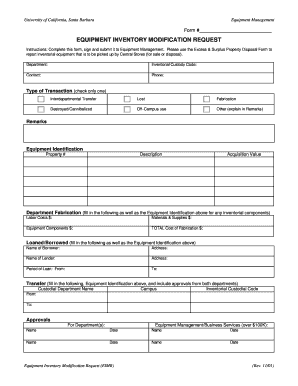

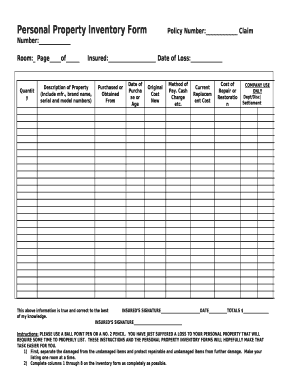

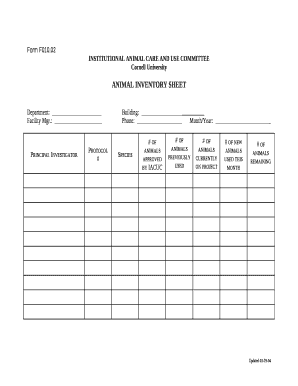

What is inventory adjustment document?

The Inventory Adjustment (IA) document records adjustments in on-hand quantities or in unit costs of stock items. Date of Record. Default is the date the system accepts the document.

How do you do an inventory adjustment?

Here are a few simple steps you can follow to make an inventory adjustment: Gather information. Determine the amount of the company's beginning inventory for the period you're calculating. Calculate the cost of goods sold. Evaluate inventory. Accurate inventory. Understated inventory. Overstated inventory.

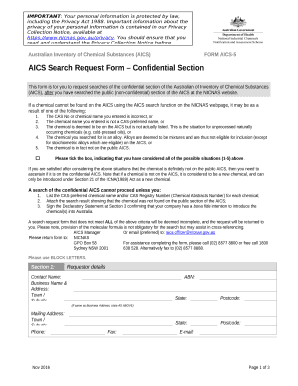

What are some examples of when you would need to fill out an inventory adjustment form?

Inventory Adjustments: An Overview Waste: Expired or obsolete inventory (common in food and consumer goods). Breakage: Damaged inventory that cannot be legally sold as new. Shrinkage: Inventory lost to theft. Write-offs: Inventory lost to other reasons.

What are the two kinds of inventory adjustments?

There are two types of adjustments that can be made to inventory: Stock on Hand: The quantity of stock on hand, or salable stock, is increased or decreased. Unavailable Inventory: The quantity of stock on hand does not change, but the quantity of unavailable stock, or non-salable stock, is increased or decreased.

How do you record inventory adjusting entry?

The first adjusting entry clears the inventory account's beginning balance by debiting income summary and crediting inventory for an amount equal to the beginning inventory balance. The second adjusting entry debits inventory and credits income summary for the value of inventory at the end of the accounting period.