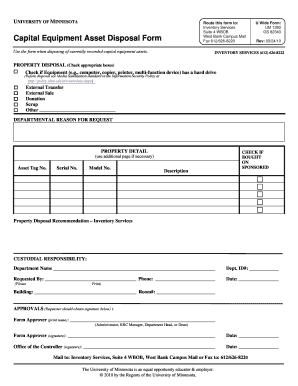

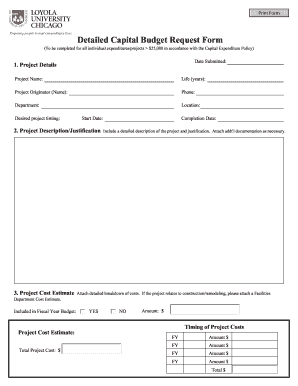

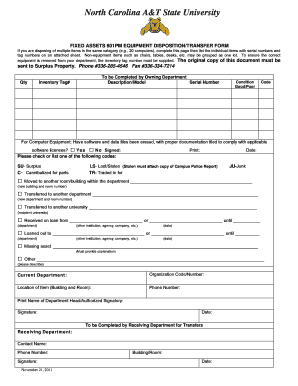

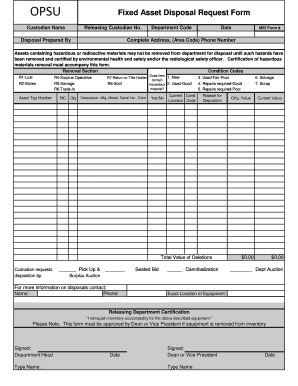

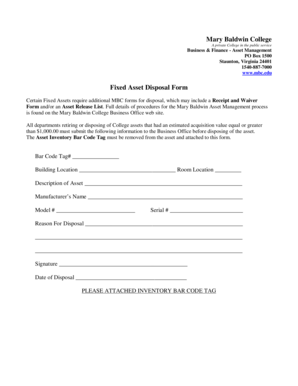

Fixed Assets Disposal Form Template

What is Fixed assets disposal form template?

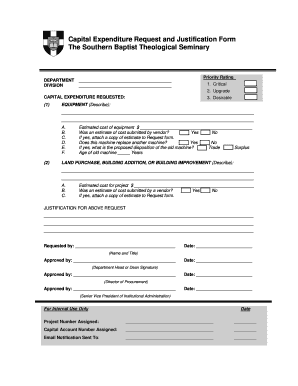

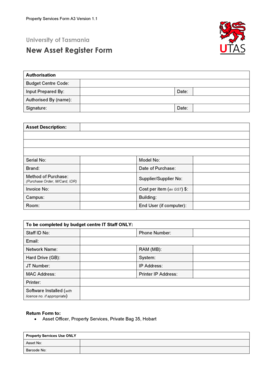

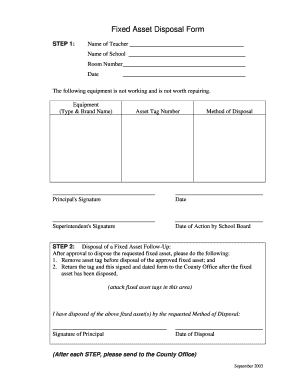

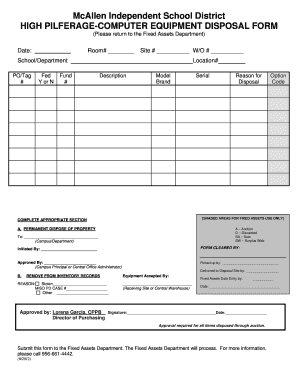

A Fixed assets disposal form template is a document used to record the disposal of fixed assets within a company. It includes details such as the asset name, date of disposal, reason for disposal, disposal method, and final disposition of the asset.

What are the types of Fixed assets disposal form template?

There are several types of Fixed assets disposal form templates available, including:

Basic Fixed assets disposal form template

Detailed Fixed assets disposal form template

Legal Fixed assets disposal form template

How to complete Fixed assets disposal form template

Completing a Fixed assets disposal form template is a simple process that involves the following steps:

01

Fill in the asset details such as name, description, and acquisition date.

02

Specify the reason for disposal and the method of disposal.

03

Include any relevant supporting documentation, such as photos or appraisal reports.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Fixed assets disposal form template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you record the disposal of an asset?

When businesses dispose of an asset, they debit the sale proceeds and accumulated depreciation accounts and credit the asset's initial cost. Moreover, they record the gain or loss on the disposal by passing a credit or debit entry.

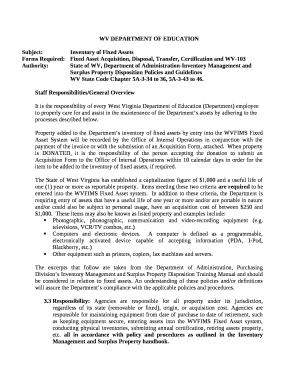

What is the document for asset disposal?

Example of a Fixed Asset Disposal ABC Corporation buys a machine for $100,000 and recognizes $10,000 of depreciation per year over the following ten years. At that time, the machine is not only fully depreciated, but also ready for the scrap heap.

What is required for asset disposal?

The asset disposal may be a result of several events: An asset is fully depreciated and must be disposed of. An asset is sold because it is no longer useful or needed. An asset must be removed from the books due to unforeseen circumstances (e.g., theft).

What information should be included in asset disposal forms?

How to record disposal of assets Calculate the asset's depreciation amount. The first step is to ensure you have the accurate value of the asset recorded at the time of its disposal. Record the sale amount of the asset. Credit the asset. Remove all instances of the asset from other books. Confirm the accuracy of your work.

Who can use an asset disposal form?

An asset disposal form is a form used to document the disposal process of assets. It is used by banks, state agencies, and other businesses to keep track of their assets.

How do you record the disposal of fixed assets?

To create a disposal journal, go to Fixed assets > Journal entries > Fixed assets journal, on the Action Pane, select Lines. Select Disposal – scrap, and select a fixed asset ID. To fully dispose of the asset, don't enter a value in either the Debit field or the Credit field.