Donation Acceptance Agreement

What is Donation acceptance agreement?

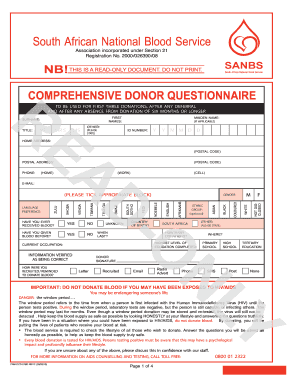

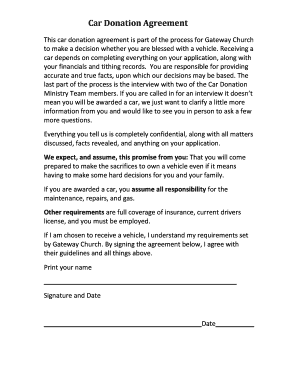

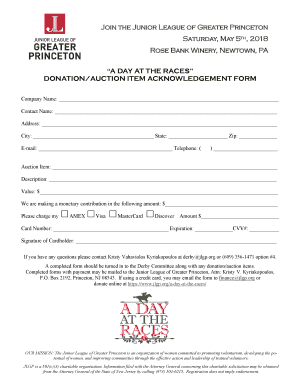

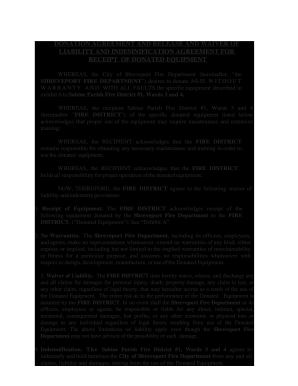

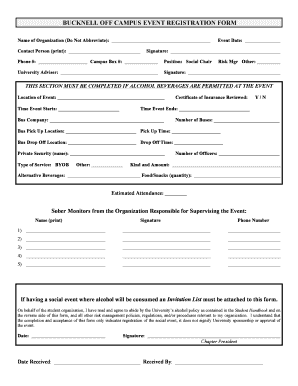

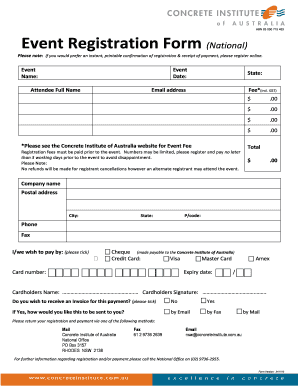

A Donation Acceptance Agreement is a legally binding document between a donor and a recipient organization that outlines the terms and conditions of the donation being made. It specifies the details of the donation, including the amount, purpose, and any additional requirements or restrictions.

What are the types of Donation acceptance agreement?

There are several types of Donation Acceptance Agreements, including:

Monetary donations agreement

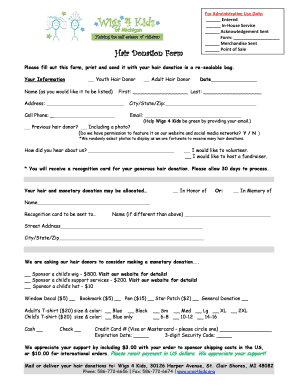

In-kind donations agreement

Restricted donations agreement

Unrestricted donations agreement

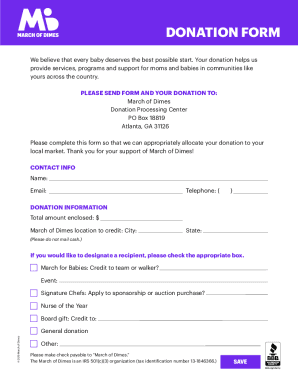

How to complete Donation acceptance agreement

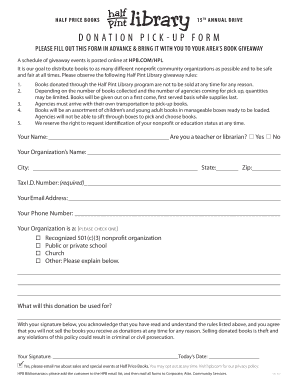

Completing a Donation Acceptance Agreement is a straightforward process. Here are the steps:

01

Fill in the details of the donor and recipient organizations

02

Specify the amount or nature of the donation

03

Outline any specific terms or conditions of the donation

04

Sign and date the agreement to make it legally binding

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Donation acceptance agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write a donation agreement?

A donation agreement will include the names of the parties, a description of the donation, whether a receipt that was given, and possibly the intended use for the donation. The agreement should also include a revocability (whether the donation can be taken back) section and define expense responsibility.

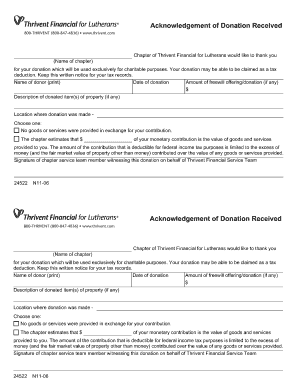

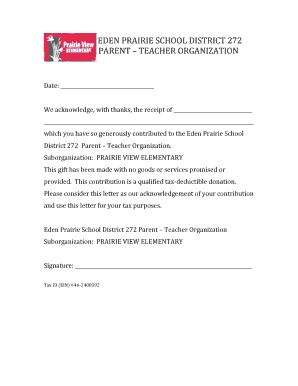

How do I write a donation acceptance letter?

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

What is a charitable gift agreement?

Gift agreements are completed and signed to prevent misunderstandings, and show your donor that you care and that they are valued and important. As a nonprofit organization must keep accurate records on donations received, so must a donor keep records of donations they've made — especially when it comes to tax time.

How do I write a donation proposal?

Personalize the Letter as Much as Possible Use the person's name in the salutation and when you make your ask (when appropriate) Acknowledge and thank them for their last gift and mention the specific donation amount (when applicable) Include language and references specific to each segment of your donor list.

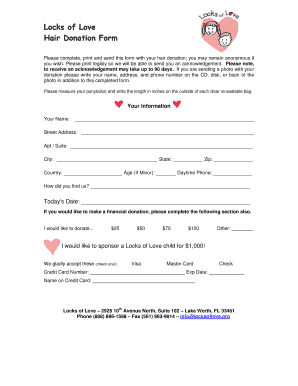

How do you make a donation in honor of someone wording?

Donating in Someone's Memory Examples: “I know how much [organization name] meant to [individual's name], and I wanted to honor their memory this Christmas.” “Thinking of you during this first Christmas season without [individual's name]. To honor his memory we have made a donation in his name to [organization name].”

What is the purpose donation agreement?

A donation agreement may be used to ensure that a donor's promise can be relied upon, set the expectations of both donor and donee, and prevent misunderstandings.