Get the free Gift Transmittal Form - American Brain Tumor Association - abta

Show details

Donation Form. Donor Name: Donor Street Address: ... CVV #:. (For Monthly Giving Only). Tribute gift: In memory of: ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gift transmittal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift transmittal form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift transmittal form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift transmittal form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

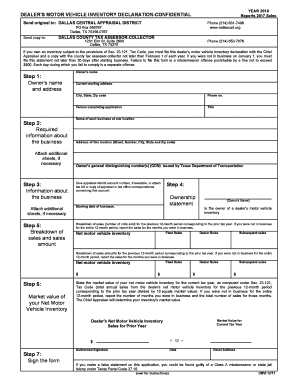

How to fill out gift transmittal form

How to fill out a gift transmittal form:

01

Start by gathering all the necessary information regarding the gift. This includes the item description, estimated value, and any relevant documentation such as receipts or appraisals.

02

Fill out the sender's information accurately. This includes the full name, address, and contact information of the person or organization sending the gift.

03

Fill out the recipient's information completely. Provide the recipient's full name, address, and any other requested contact details.

04

Indicate the purpose of the gift. Specify whether it is for personal use, a special occasion, a charitable donation, or any other relevant purpose.

05

Provide a detailed description of the gift. Include specifics such as the item's name, brand, model, and any additional features or accessories it may come with.

06

Estimate the value of the gift. If you are unsure about the exact value, it is recommended to provide an estimated range or consult a professional appraiser if necessary.

07

Attach any supporting documentation for the gift, such as receipts, invoices, or appraisals. This will help provide proof of value and authenticity if required.

Who needs a gift transmittal form:

01

Individuals or organizations sending gifts to others, especially in a professional or business setting, may require a gift transmittal form. This could include companies sending corporate gifts to clients or employees, as well as individuals sending gifts for special occasions like birthdays or weddings.

02

Non-profit organizations accepting donations also often use gift transmittal forms to document and track the gifts they receive. This helps ensure transparency and accountability when it comes to managing donated items and funds.

03

Government agencies or institutions that receive gifts, such as museums or public libraries, may also require gift transmittal forms to properly acknowledge and keep records of the gifts received.

Overall, anyone involved in the process of sending or receiving valuable gifts can benefit from using a gift transmittal form to maintain accurate records and facilitate the smooth transfer of gifts.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gift transmittal form?

A gift transmittal form is a document used to report gifts that are given or received.

Who is required to file gift transmittal form?

Individuals or organizations who give or receive gifts above a certain value may be required to file a gift transmittal form.

How to fill out gift transmittal form?

Gift transmittal forms typically require information about the giver, recipient, value of the gift, and purpose of the gift.

What is the purpose of gift transmittal form?

The purpose of a gift transmittal form is to provide transparency and accountability in the giving and receiving of gifts.

What information must be reported on gift transmittal form?

Information such as the names of the giver and recipient, value of the gift, and purpose of the gift must be reported on a gift transmittal form.

When is the deadline to file gift transmittal form in 2023?

The deadline to file gift transmittal form in 2023 may vary depending on the jurisdiction or organization requiring the form.

What is the penalty for the late filing of gift transmittal form?

Penalties for late filing of gift transmittal form may include fines or other consequences imposed by the relevant authority.

How can I edit gift transmittal form from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your gift transmittal form into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete gift transmittal form online?

Easy online gift transmittal form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an eSignature for the gift transmittal form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your gift transmittal form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your gift transmittal form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.