Technology Equipment Loan Agreement

What is Technology equipment loan agreement?

A Technology equipment loan agreement is a legal contract that outlines the terms and conditions of borrowing technology equipment. It specifies the responsibilities of both the lender and the borrower regarding the use, maintenance, and return of the equipment.

What are the types of Technology equipment loan agreement?

There are several types of Technology equipment loan agreements, including:

Short-term loan agreement for temporary equipment needs

Long-term lease agreement for extended use of technology equipment

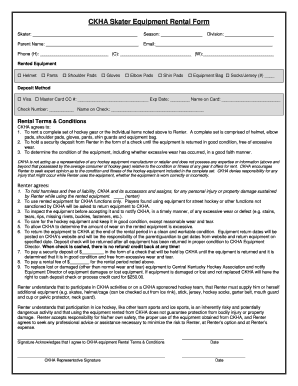

Equipment rental agreement for periodic use of technology equipment

How to complete Technology equipment loan agreement

Completing a Technology equipment loan agreement is a simple process. Here are the steps to follow:

01

Gather the necessary information about the equipment being borrowed

02

Fill in the details of the agreement, including the duration of the loan, responsibilities of each party, and any additional terms

03

Review the document carefully before signing to ensure all details are accurate

By using pdfFiller, you can easily create, edit, and share Technology equipment loan agreements online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate solution for managing your documents effectively.

Video Tutorial How to Fill Out Technology equipment loan agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a equipment loan?

Equipment financing is a type of business loan, which enables businesses to purchase equipment and machinery on credit via an operating lease, hire purchase, or a finance lease.

Is it hard to get a loan for equipment?

Equipment loans typically are not hard to get. You can qualify for one with moderate credit and a sufficient down payment, even if you're running a startup.

What is the agreement for use of equipment?

An equipment use agreement, sometimes called an equipment lease agreement, is a legal contract that allows a lessee to lease a piece of equipment from the owner or lessor. The lessee will be required to make periodic payments for the use of the equipment throughout the duration of the agreement.

What is the LTV for equipment financing?

When financing equipment with a loan, the lender uses the value of the equipment to determine a borrowing base, which is the amount of money a company can borrow. For equipment, the borrowing base is a percentage of the market value of the equipment, which is typically based on a loan-to-value (LTV) ratio of 50%.

What are the typical terms on an equipment loan?

Equipment financing usually comes with a fixed interest rate and a requirement that you make periodic payments to repay the loan. Usually, the loan term falls somewhere between a three to 10 years. The equipment you're buying acts as collateral for the loan.

What is equipment loan agreement?

An equipment loan agreement is a business agreement intended to offer a business loan for a company to purchase equipment. Oftentimes the equipment loan agreement uses the equipment itself as collateral for the loan, making it an appealing borrowing and lending situation for both parties.