Employee Equipment Loan Agreement Template

What is Employee equipment loan agreement template?

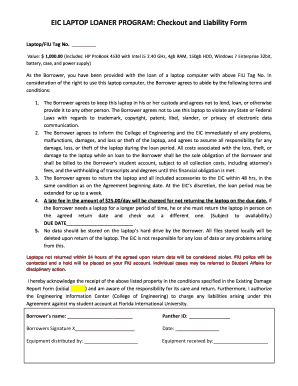

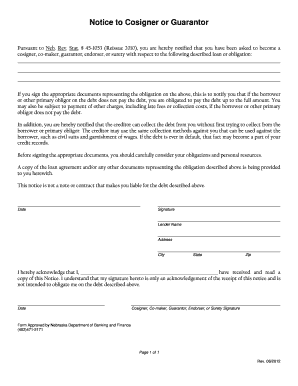

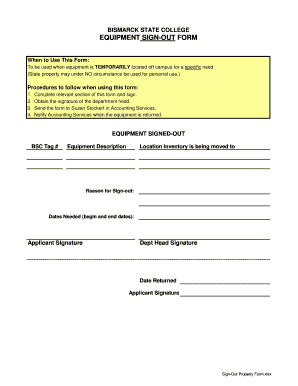

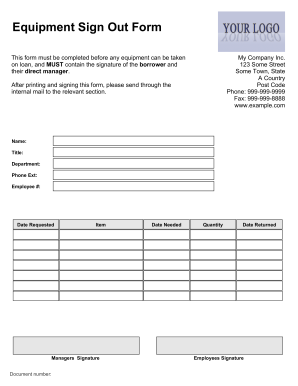

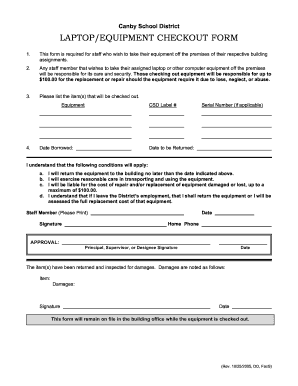

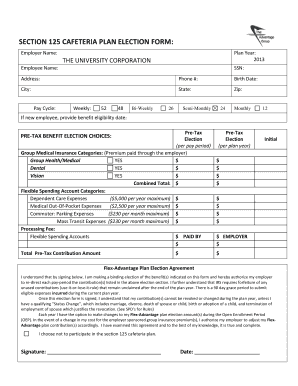

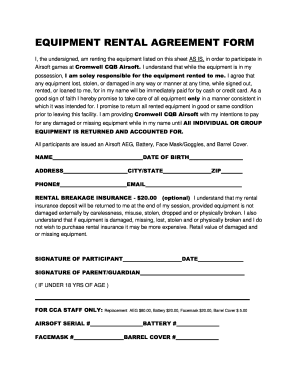

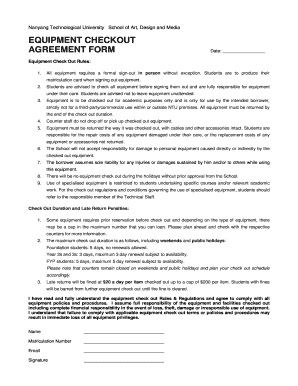

An Employee equipment loan agreement template is a document that outlines the terms and conditions under which an employer lends equipment to an employee for work-related purposes. This agreement helps protect both parties by setting clear expectations and responsibilities.

What are the types of Employee equipment loan agreement template?

There are several types of Employee equipment loan agreement templates that can be used depending on the specific needs of the employer and employee. Some common types include:

How to complete Employee equipment loan agreement template

Completing an Employee equipment loan agreement template is a straightforward process that involves filling in the necessary information and signatures. Here are the steps to complete the agreement:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.