Loan Agreement Letter

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

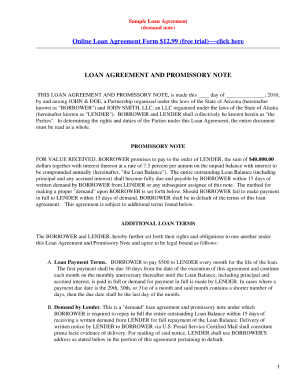

How do I write a letter of agreement for a loan?

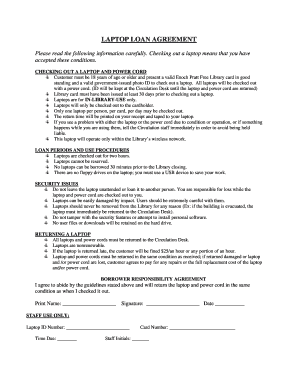

The loan agreement letter format will follow that of any legal contract. The content must explain the financial obligations of both parties: what the lender will provide and how the borrower is expected to return the sum. The time period and details of payment should be included in this letter, as well.

How do I write a quick loan agreement?

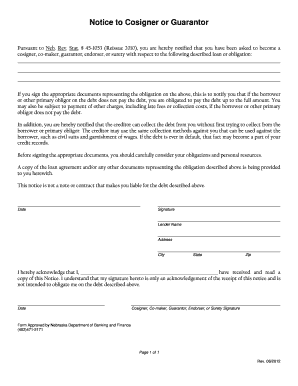

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan cosigner, if applicable. Amount borrowed. Date the loan was provided. Expected repayment date. Interest rate, if applicable. Annual percentage rate (APR), if applicable.

How do I write a loan agreement between friends?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Can I write my own loan agreement?

A loan agreement should accompany any loan of money. For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

How do I write a simple loan agreement?

Common items in personal loan agreements. Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more.

How do I make a simple loan agreement?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.