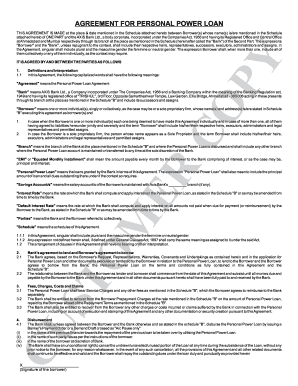

Loan Agreement Between Individuals

What is a Loan agreement between individuals?

A Loan agreement between individuals is a legal contract that outlines the terms and conditions of a loan between two private parties. It specifies the amount borrowed, the interest rate, repayment schedule, and any other relevant details to ensure both parties are protected.

What are the types of Loan agreement between individuals?

There are several types of Loan agreements between individuals, including:

Personal loan agreement

Business loan agreement

Family loan agreement

Friend loan agreement

How to complete Loan agreement between individuals

Completing a Loan agreement between individuals is a simple process that involves the following steps:

01

Fill in the borrower's and lender's information

02

Specify the loan amount, interest rate, and repayment terms

03

Include any collateral or guarantees

04

Sign and date the agreement

05

Share a copy with both parties for reference

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Loan agreement between individuals

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write a loan agreement between two people?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How do you write a loan agreement between two people?

THIS AGREEMENT, made and executed at _____ on the __ day of _____, BETWEEN _________________, hereinafter referred to as “the Lender,” AND _________________ hereinafter referred to as “the Borrower,” shall be binding upon and lawful against the parties hereto and their respective heirs, executors, administrators, and

How does a loan contract work?

Loan contracts are written agreements between financial lenders and borrowers. Both parties sign the loan contract in writing in case one of the parties breaches the contract. This agreement states that the borrower will repay the loan and that the lender will give the borrower money.

What is finance agreement between two parties?

A finance agreement is a document, which outlines how a particular business project or plan is to be properly financed. It typically takes the form of a contract between two parties. the lender (the financer) and a borrower (the business).

Can I write my own loan agreement?

A loan agreement should accompany any loan of money. For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

What is a loan contract between 2 parties?

A loan agreement is a written agreement between a lender that lends money to a borrower in exchange for repayment plus interest. The borrower will be required to pay back the loan in ance with a payment schedule (unless there is a balloon payment).