Simple Loan Agreement (Small Business) Templates

What are Simple Loan Agreement (Small Business) Templates?

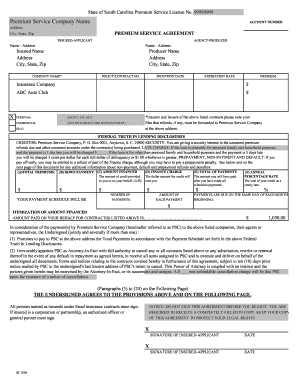

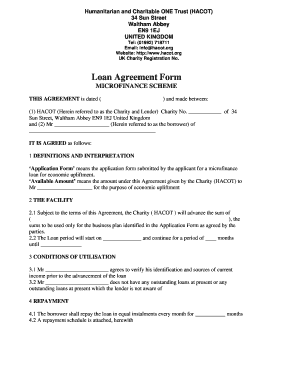

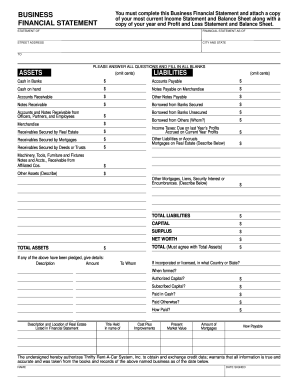

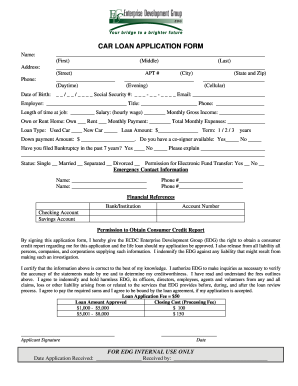

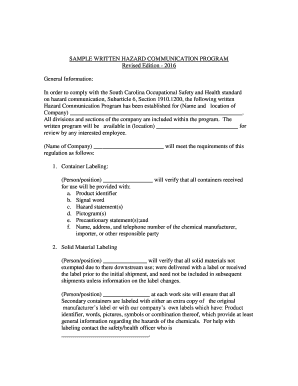

Simple Loan Agreement Templates for Small Businesses are pre-designed forms that outline the terms of a loan between a lender and a borrower. These templates are essential for businesses looking to formalize loan agreements and ensure clarity and legal compliance.

What are the types of Simple Loan Agreement (Small Business) Templates?

There are various types of Simple Loan Agreement Templates for Small Businesses, including: 1. Secured Loan Agreement Template 2. Unsecured Loan Agreement Template 3. Personal Guarantee Loan Agreement Template 4. Installment Loan Agreement Template 5. Revolving Credit Agreement Template

How to complete Simple Loan Agreement (Small Business) Templates

Completing Simple Loan Agreement Templates for Small Businesses is an easy process that involves the following steps: 1. Fill in the borrower and lender's information 2. Outline the loan amount, interest rate, and repayment terms 3. Include any collateral or guarantees if applicable 4. Review and sign the agreement to finalize the document

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.