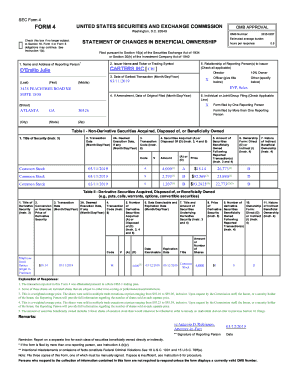

Fiscal Sponsorship Model B

What is Fiscal sponsorship model b?

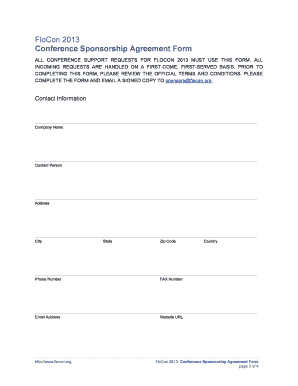

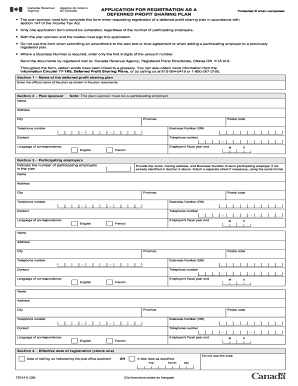

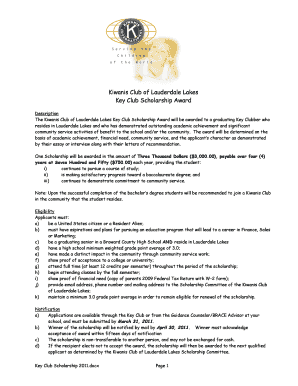

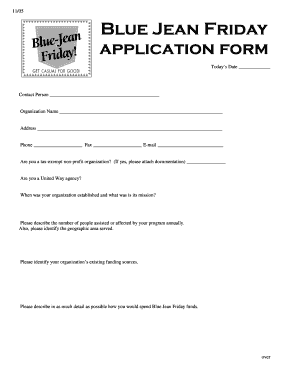

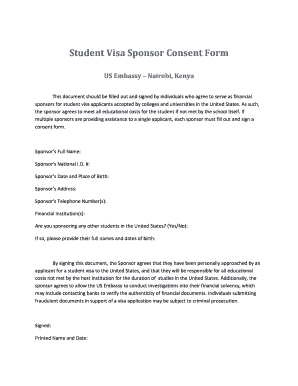

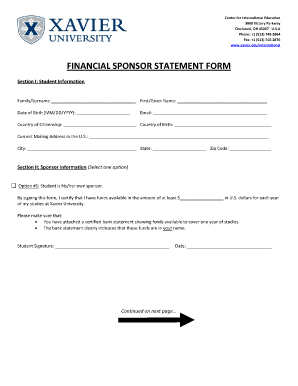

Fiscal sponsorship model b is a unique arrangement where a nonprofit organization offers its legal and tax-exempt status to another organization, allowing them to receive grants and tax-deductible donations. This model enables smaller organizations to operate under the umbrella of a larger, more established nonprofit, providing them with administrative support and oversight.

What are the types of Fiscal sponsorship model b?

There are several types of Fiscal sponsorship model b, including comprehensive fiscal sponsorship, administrative fiscal sponsorship, and project-based sponsorship. Each type offers different levels of support and involvement from the sponsoring organization.

How to complete Fiscal sponsorship model b

To successfully complete Fiscal sponsorship model b, follow these steps: 1. Identify a suitable nonprofit organization to act as the fiscal sponsor. 2. Establish a clear agreement outlining the responsibilities and expectations of both parties. 3. Submit all necessary documentation and comply with reporting requirements. 4. Maintain open communication with the fiscal sponsor to ensure a successful partnership.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.