Fill In The Blank Promissory Note Pdf

What is Fill in the blank promissory note pdf?

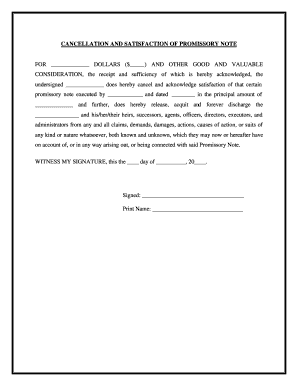

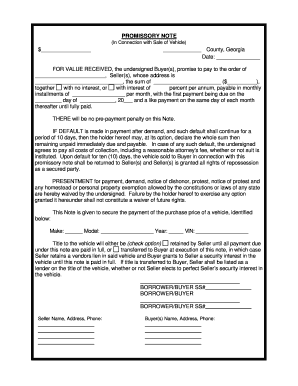

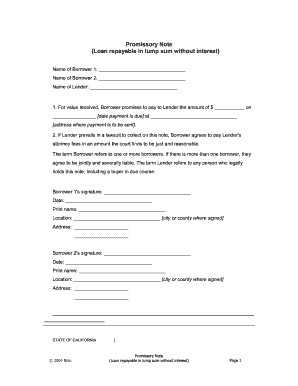

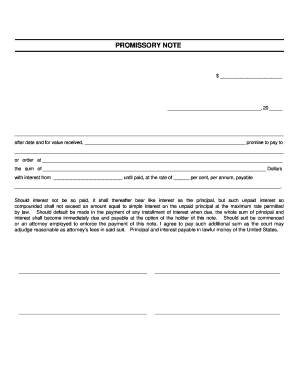

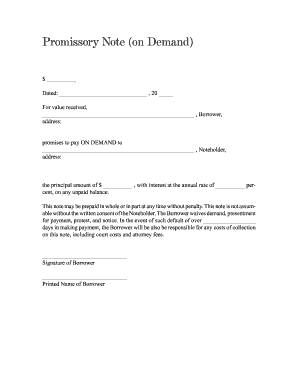

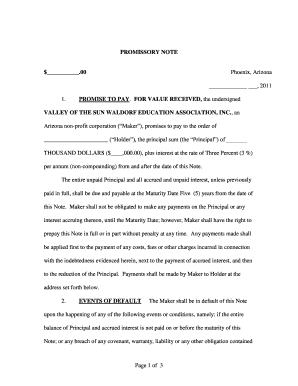

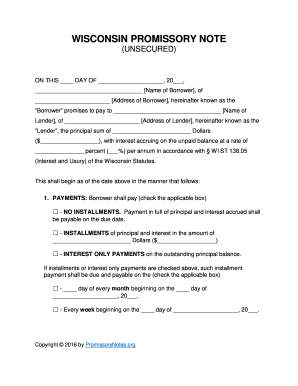

A Fill in the blank promissory note pdf is a legal document that outlines the terms of a loan agreement between a lender and a borrower. It includes details such as the amount borrowed, repayment schedule, interest rate, and consequences for defaulting on the loan.

What are the types of Fill in the blank promissory note pdf?

There are several types of Fill in the blank promissory note pdf, including:

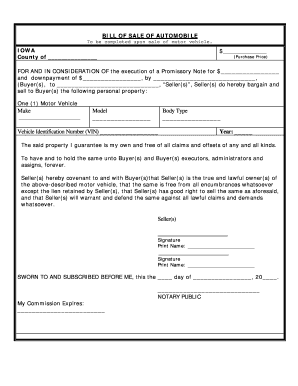

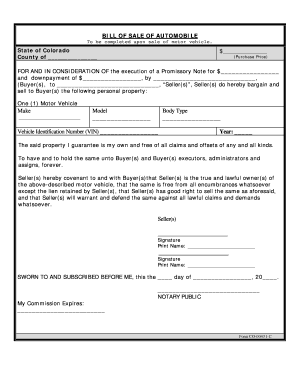

Secured promissory note - backed by collateral such as real estate or personal property

Unsecured promissory note - not backed by any collateral

Fixed-rate promissory note - with a set interest rate for the entire loan term

Variable-rate promissory note - with an interest rate that can change based on market conditions

How to complete Fill in the blank promissory note pdf

Completing a Fill in the blank promissory note pdf is a simple process that involves the following steps:

01

Fill in the borrower's and lender's information

02

Enter the loan amount and repayment terms

03

Include any applicable interest rate and late fees

04

Specify the collateral, if any, for a secured loan

05

Sign and date the document to make it legally binding

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Fill in the blank promissory note pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is needed to make a promissory note legal?

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

How to write a promissory note PDF?

Commonly Includes (5) The Parties – Full names and addresses of the borrower and lender. Principal Amount ($) – The original amount of money owed. Interest Rate (%) – Percentage of the principal amount paid for the loan. Maturity Date – Final date when the principal + interest must be paid.

Do promissory notes have to be notarized?

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

Can a promissory note be handwritten?

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

What is a promissory note PDF?

A promissory note is also referred to as a “Promise to Pay” note or a “Note payable”. The promissory note is a legal document and includes all the details of the amount that is owed by the Borrower to the Lender, as well as the Repayment structure.

Can I write my own promissory note?

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.