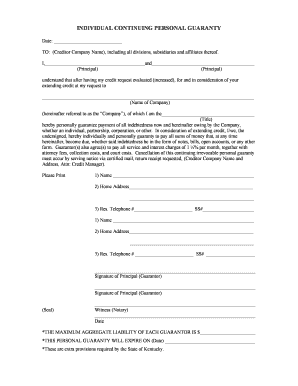

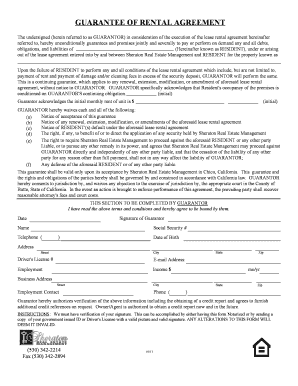

Personal Guaranty Agreement Sample

What is Personal guaranty agreement sample?

A Personal guaranty agreement sample is a legal document that establishes a person's commitment to be personally responsible for a debt or obligation in case the borrower defaults or is unable to fulfill their obligations. It serves as a security measure for the lender to ensure repayment.

What are the types of Personal guaranty agreement sample?

There are several types of Personal guaranty agreement samples, including:

Unlimited personal guaranty - where the guarantor is responsible for the full amount of the debt

Limited personal guaranty - where the guarantor is responsible only up to a certain amount or under specific conditions

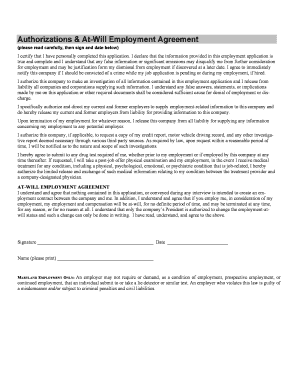

How to complete Personal guaranty agreement sample

Completing a Personal guaranty agreement sample is a straightforward process. Here are the steps to follow:

01

Read the agreement carefully and understand your obligations as a guarantor.

02

Fill in your personal information accurately, including name, address, and contact details.

03

Sign the document in the presence of a notary public to make it legally binding.

04

Keep a copy of the agreement for your records and provide a copy to the lender.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Personal guaranty agreement sample

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

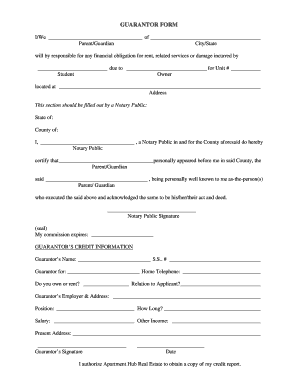

Does a personal guaranty need to be notarized?

Whether the personal guarantee loan agreement must be witnessed or notarized will be determined by the lender's requirements, and possibly by state law. If the loan covers real estate, the agreement will most likely need to be witnessed and notarized in the same manner as required for a deed.

What is a personal guaranty agreement?

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

What is personal guaranty short form?

This is a standard short-form guaranty (also guarantee) for use as an ancillary agreement to a party's loan transaction where the obligations under the loan are guaranteed by an individual. The guarantor unconditionally guarantees the performance of a party's obligations under the underlying loan documents.

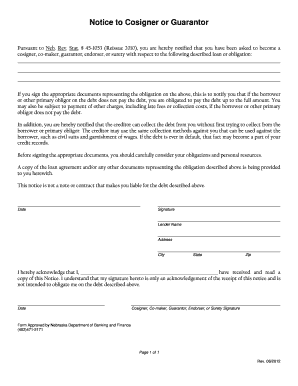

Do personal guarantees have to be notarized?

Whether the personal guarantee loan agreement must be witnessed or notarized will be determined by the lender's requirements, and possibly by state law. If the loan covers real estate, the agreement will most likely need to be witnessed and notarized in the same manner as required for a deed.

What is the difference between personal guarantee and personal guaranty?

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

Do personal guarantees require written contracts?

There Must be Writing in Place to Enforce a Personal Guarantee. An enforceable personal guarantee must contain all of the following elements: There needs to exist an underlying obligation of the company. The guarantee must be in writing and must stand on its own as an enforceable contract.