Fiscal Sponsorship Model B

What is Fiscal sponsorship model b?

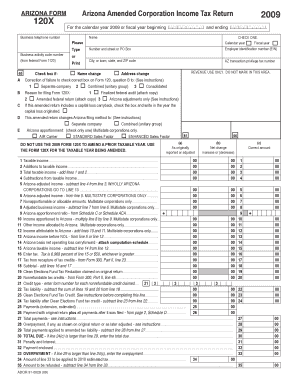

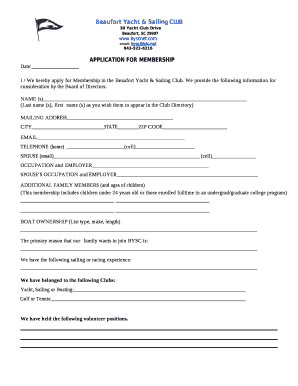

Under the Fiscal sponsorship model b, a nonprofit organization provides administrative and financial oversight to a project or initiative that does not have its own tax-exempt status. This type of sponsorship allows the project to receive donations and grants through the nonprofit, effectively acting as a fiscal agent for the project.

What are the types of Fiscal sponsorship model b?

There are several types of Fiscal sponsorship model b that organizations can choose from based on their needs and goals. Some common types include Comprehensive Fiscal Sponsorship, Administrative Fiscal Sponsorship, and Group Exemption Fiscal Sponsorship.

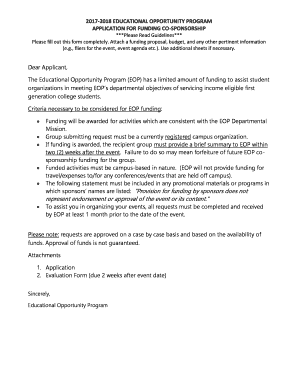

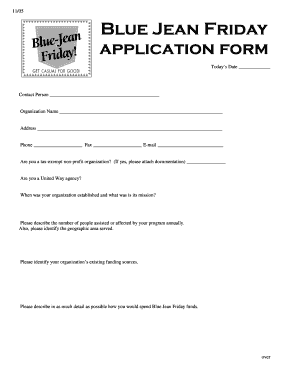

How to complete Fiscal sponsorship model b

Completing the Fiscal sponsorship model b involves several key steps to ensure a successful partnership between the nonprofit organization and the sponsored project. These steps include:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.