Irs Fiscal Sponsorship

What is Irs fiscal sponsorship?

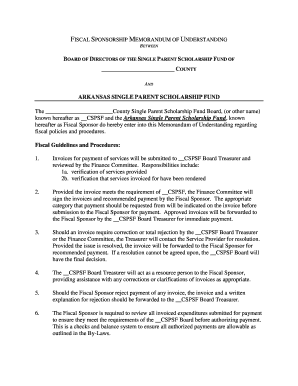

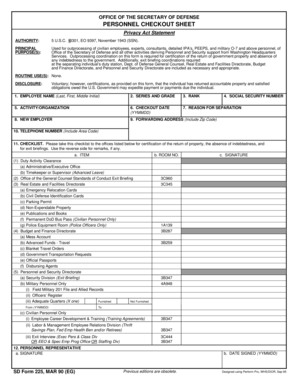

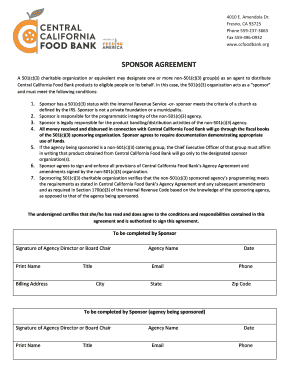

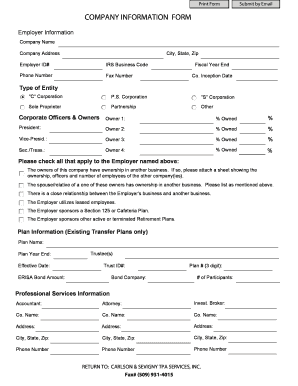

Irs fiscal sponsorship refers to a scenario where a non-profit organization provides its legal and tax-exempt status to another organization or individual to help them raise funds and operate as a non-profit entity. This arrangement allows the sponsored organization to benefit from the tax-exempt status of the sponsoring organization.

What are the types of Irs fiscal sponsorship?

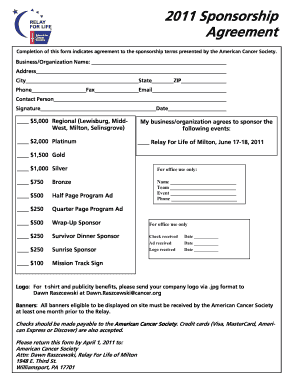

There are mainly two types of Irs fiscal sponsorship: comprehensive fiscal sponsorship and pre-approved grant relationship. In comprehensive fiscal sponsorship, the sponsored organization becomes a program of the sponsoring organization, whereas in a pre-approved grant relationship, the sponsored organization remains separate but receives financial assistance from the sponsoring organization.

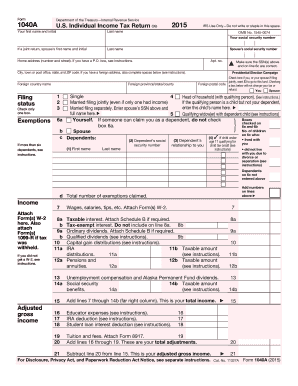

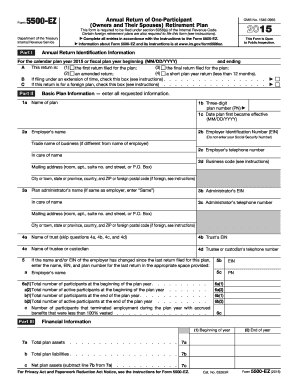

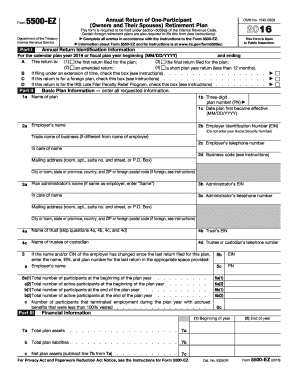

How to complete Irs fiscal sponsorship

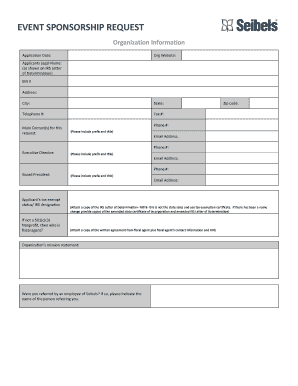

Completing Irs fiscal sponsorship involves several steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.