Fiscal Sponsorship Termination

What is Fiscal sponsorship termination?

Fiscal sponsorship termination refers to the conclusion or ending of a fiscal sponsorship agreement between a sponsored project and a sponsoring organization. It typically involves the formal termination of the financial relationship and responsibilities between the two parties.

What are the types of Fiscal sponsorship termination?

There are two main types of fiscal sponsorship termination: voluntary termination and involuntary termination.

Voluntary termination: Occurs when either the sponsored project or the sponsoring organization decides to end the fiscal sponsorship agreement amicably.

Involuntary termination: Happens when either party breaches the terms of the agreement, leading to the termination of the fiscal sponsorship.

How to complete Fiscal sponsorship termination

To complete fiscal sponsorship termination successfully, follow these steps:

01

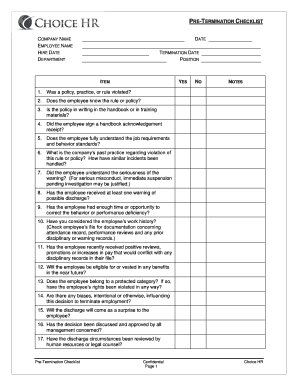

Review the terms of the fiscal sponsorship agreement regarding termination

02

Communicate with the other party about the decision to terminate

03

Formally document the termination in writing, outlining any remaining financial obligations or transfer of assets

04

Ensure all parties sign the termination agreement to make it legally binding

05

Close out any remaining financial matters and officially end the fiscal sponsorship relationship

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Fiscal sponsorship termination

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you terminate a sponsorship?

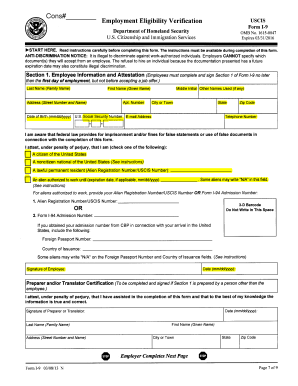

Visa sponsorships cannot be revoked arbitrarily. There must be evidence-backed reasons behind the revocation. If both of the parties (i.e., the sponsor and immigrant) agree to the revocation, the sponsorship can be canceled by sending in a written request to the USCIS.

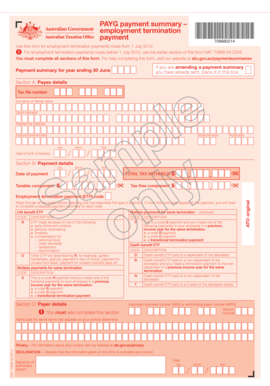

What is the IRS rule on fiscal sponsorship?

Using a fiscal sponsor satisfies IRS requirements as long as the fiscal sponsor maintains the right to decide, at its own discretion, how it will use contributions. Maintaining control over the donated funds is a requirement of a legitimate fiscal sponsor arrangement.

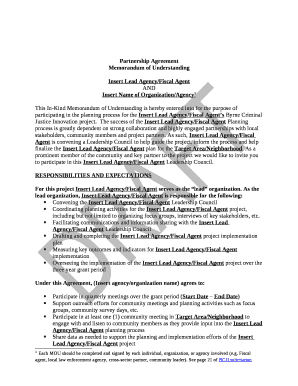

What are the obligations of a fiscal sponsor?

A fiscal sponsor is a 501(c)(3) nonprofit organization that agrees to provide fiduciary oversight, financial management, and other administrative services to support the activities of groups or individuals engaged in work that furthers the fiscal sponsor's mission.

What are the risks of being a fiscal sponsor?

The Benefits and Risks of Fiscal Sponsorship Liability. Project Oversight. Reputation and Mission Creep. Reduced Costs/Administrative Burden. Loss of Control. Risk of Funds. Difficulty Finding a Sponsor.

What is the IRS definition of fiscal sponsorship?

Definition. A fiscal sponsorship involves an existing 501(c)(3) nonprofit offering to provide its tax-exemption and associated benefits to another group, usually a charitable project. The project should generally be aligned with the overall mission of the sponsoring charity.

What is the difference between a fiscal sponsorship and a 501 C 3?

A fiscal sponsor is a 501(c)(3) organization that takes nonexempt projects or causes under its umbrella and 'sponsors' them in an arrangement called Fiscal Sponsorship. This provides the sponsored group 501(c)(3) 'status' so that they can start tax-deductible fundraising activities quickly.