What is Fiscal sponsorship accounting?

Fiscal sponsorship accounting is a financial management arrangement in which a nonprofit organization (the sponsor) provides administrative and financial oversight to a project or individual (the sponsored organization) that does not have its own tax-exempt status. This allows the sponsored organization to receive tax-deductible donations and grants through the sponsor, who acts as a fiscal agent.

What are the types of Fiscal sponsorship accounting?

There are several types of fiscal sponsorship accounting arrangements, including:

Direct Project Sponsorship: The sponsor provides financial oversight and administrative support for a specific project.

Group Exemption Sponsorship: The sponsor is a parent organization that has obtained a group tax exemption from the IRS, allowing it to sponsor multiple projects or organizations.

Preapproved Grant Relationship: The sponsor has received approval from the IRS to sponsor specific projects or organizations without the need for individual agreements.

Comprehensive Fiscal Sponsorship: The sponsor provides extensive support, including financial management, legal compliance, and administrative services, to the sponsored organization.

How to complete Fiscal sponsorship accounting

Completing fiscal sponsorship accounting successfully requires careful planning and attention to detail. Here are some steps to guide you through the process:

01

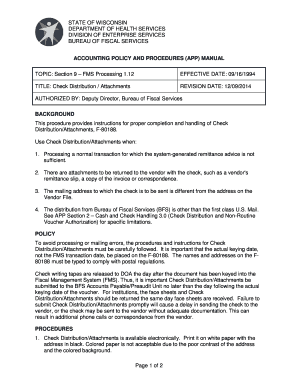

Establish a formal agreement: Clearly define the roles and responsibilities of both the sponsor and the sponsored organization in a written agreement.

02

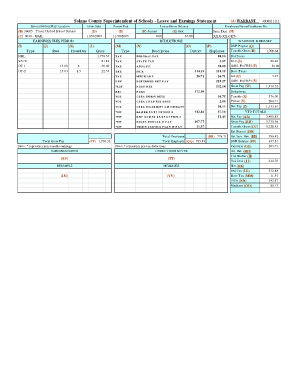

Maintain accurate financial records: Keep detailed records of income, expenses, and transactions to ensure transparency and accountability.

03

Monitor compliance with legal and tax requirements: Stay informed about IRS regulations and nonprofit laws to ensure compliance.

04

Communicate regularly: Maintain open communication between the sponsor and the sponsored organization to address any issues promptly.

05

Use pdfFiller for efficient document management: pdfFiller empowers users to create, edit, and share documents online, making it easier to manage fiscal sponsorship accounting paperwork.

By following these steps and utilizing tools like pdfFiller, you can effectively navigate fiscal sponsorship accounting and ensure the success of your financial management arrangements.