Fiscal Sponsor Directory

What is Fiscal sponsor directory?

A fiscal sponsor directory is a comprehensive database listing of organizations that serve as fiscal sponsors. Fiscal sponsors are typically non-profit organizations that provide administrative and financial support to smaller, grassroots initiatives or projects that do not have their own 501(c)(3) status.

What are the types of Fiscal sponsor directory?

There are several types of fiscal sponsor directories available online. Some common types include:

National fiscal sponsor directories

Regional fiscal sponsor directories

Industry-specific fiscal sponsor directories

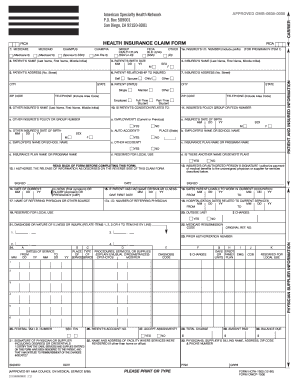

How to complete Fiscal sponsor directory

Completing a fiscal sponsor directory is a straightforward process. Here are some steps to help you:

01

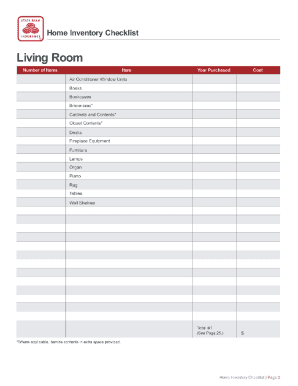

Gather all necessary information and documentation

02

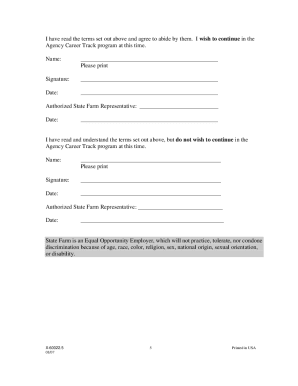

Create an account on the fiscal sponsor directory platform

03

Fill in the required fields with accurate information

04

Submit your application for review and approval

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Fiscal sponsor directory

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the difference between a fiscal agent and a fiscal sponsor?

In a fiscal agent relationship, the non-agent entity reports activity on their own financial statements, where in a fiscal sponsorship the other entity's activity is all recorded on the sponsoring entity's nonprofit financial statements because the non-agent entity gets to share the tax-exempt status.

What is the role of a fiscal sponsor?

A fiscal sponsor is a nonprofit organization that provides fiduciary oversight, financial management, and other administrative services to help build the capacity of charitable projects.

Is a fiscal agent the same as a fiscal sponsor?

A fiscal agent differs from a fiscal sponsor in that funds contributed to a fiscal sponsor on behalf of a non-profit (that lacks tax-exempt status) are tax-deductible to the donor and funds that are contributed to a fiscal agent on behalf of a non-profit are not.

What are fiscally sponsored organizations?

What is fiscal sponsorship? Fiscal sponsorship, at its core, is when a nonprofit organization extends its tax-exempt status to select groups engaged in activities related to the organization's mission.

Can you have more than one fiscal sponsor?

Can my project have more than one fiscal sponsor? Maybe. If you already have a primary fiscal sponsor and are applying to IDA for additional sponsorship please contact the Fiscal Sponsorship department to discuss your specific situation before beginning our application process.

What percentage do fiscal sponsors usually charge?

Most fiscal sponsors charge sponsored projects a fee to offset the additional cost. Generally, that fee is somewhere between 5%-10% of all funds held on behalf of the sponsored group.