What is Fiscal sponsorship models?

Fiscal sponsorship models are a legal arrangement in which a nonprofit organization extends its tax-exempt status to another group for a specific project or period of time. This allows the sponsored group to receive tax-deductible donations and grants, as well as access to other benefits of nonprofit status without having to go through the process of establishing their own separate nonprofit organization.

What are the types of Fiscal sponsorship models?

There are several types of fiscal sponsorship models, including:

Comprehensive fiscal sponsorship - The sponsor organization provides comprehensive support and oversight for all aspects of the sponsored project.

Pre-approved grant relationship - The sponsor organization acts as a conduit for grants to the sponsored project, but does not exercise oversight or control over the project's activities.

Shared services agreement - The sponsor organization provides specific services or resources to the sponsored project, such as administrative support or access to facilities.

How to complete Fiscal sponsorship models

To complete fiscal sponsorship models, follow these steps:

01

Identify a suitable sponsor organization that aligns with the goals and mission of your project.

02

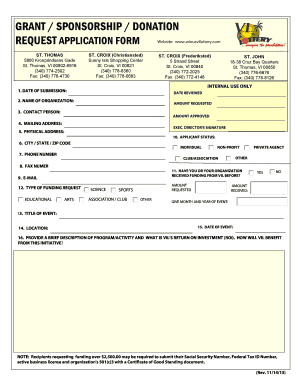

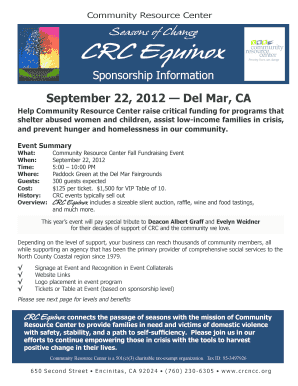

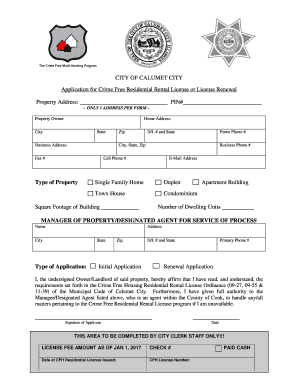

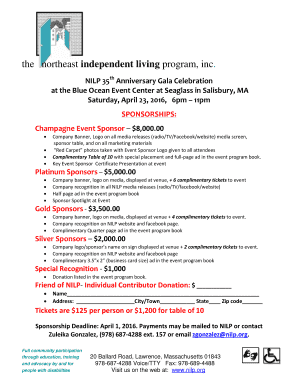

Negotiate a fiscal sponsorship agreement detailing the terms of the arrangement, including financial responsibilities, reporting requirements, and the scope of the sponsored project.

03

Submit any required documentation to the sponsor organization, such as project proposals, budgets, and work plans.

04

Maintain open communication with the sponsor organization throughout the duration of the sponsorship, providing regular updates on project progress and financials.

05

Ensure compliance with all legal and regulatory requirements governing fiscal sponsorships.

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. It is the only PDF editor you need to get your documents done efficiently and effectively.