Blank Promissory Note - Page 2

What is Blank promissory note?

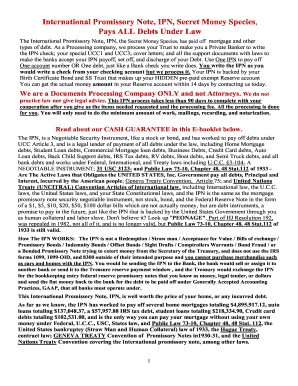

A Blank promissory note is a legal document that contains a written promise to pay a specified amount of money to a particular individual or entity at a specific date in the future. It serves as a formal agreement and outlines the terms and conditions of the loan or debt.

What are the types of Blank promissory note?

There are several types of Blank promissory notes, including: 1. Secured promissory note 2. Unsecured promissory note 3. Demand promissory note 4. Installment promissory note

How to complete Blank promissory note

Completing a Blank promissory note is a straightforward process that involves the following steps: 1. Fill in the borrower's and lender's information 2. Specify the loan amount and repayment terms 3. Include any applicable interest rates 4. Sign and date the document

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.