Security Agreement Template

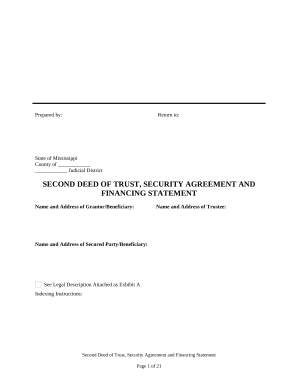

What is Security agreement template?

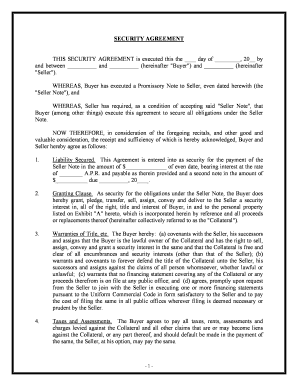

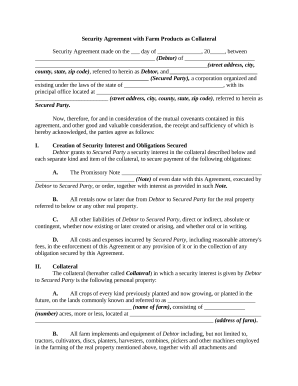

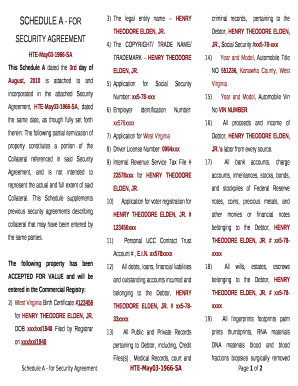

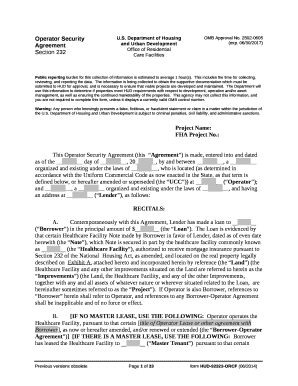

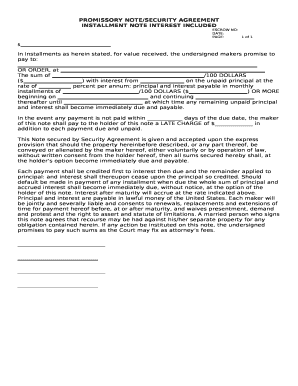

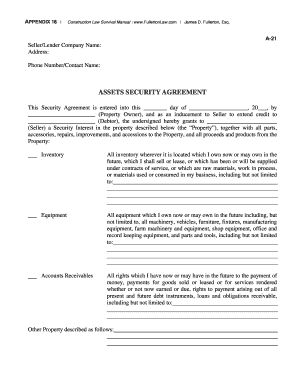

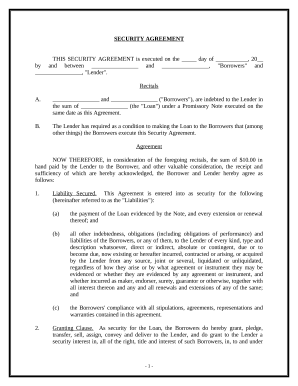

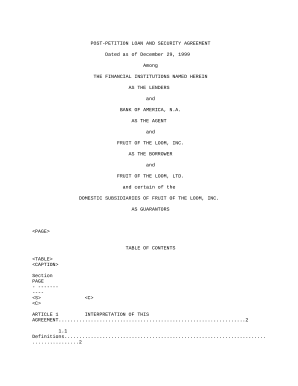

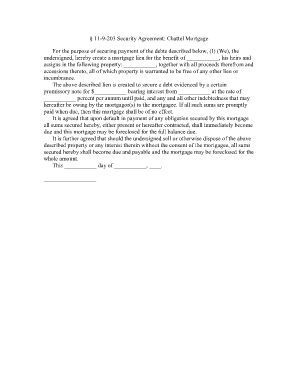

A Security agreement template is a legal document that outlines the terms and conditions of a security agreement between a lender and a borrower. It specifies the collateral that the borrower pledges to the lender in order to secure a loan.

What are the types of Security agreement template?

There are several types of Security agreement templates available, including: 1. Real Estate Security Agreement 2. Personal Property Security Agreement 3. Accounts Receivable Security Agreement 4. Equipment Security Agreement 5. Intellectual Property Security Agreement 6. Investment Securities Security Agreement

How to complete Security agreement template

Completing a Security agreement template is a simple process. Here are the steps to follow: 1. Fill in the borrower and lender information 2. Describe the collateral being pledged 3. Specify the terms of the loan 4. Include any additional clauses or provisions 5. Sign and date the agreement

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.