Security Agreement Form For Vehicle

What is Security agreement form for vehicle?

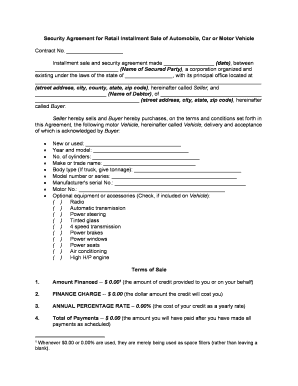

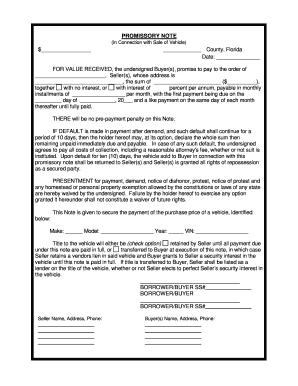

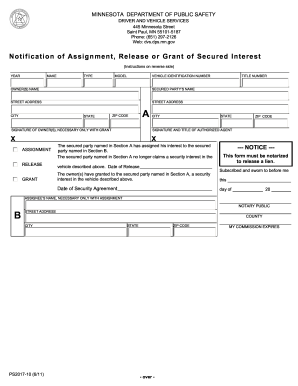

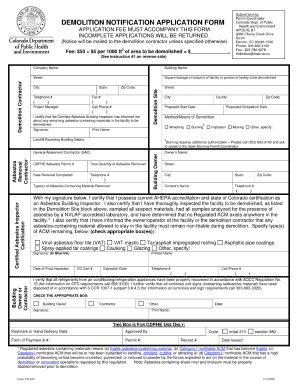

A Security agreement form for a vehicle is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This form is used to establish a security interest in the vehicle being financed, providing the lender with collateral in case the borrower defaults on the loan.

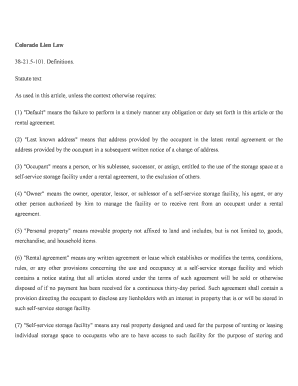

What are the types of Security agreement form for vehicle?

There are several types of Security agreement forms for vehicles, including but not limited to:

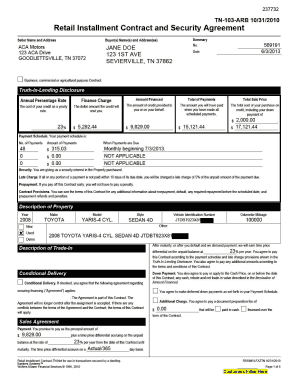

Conditional Sale Agreement

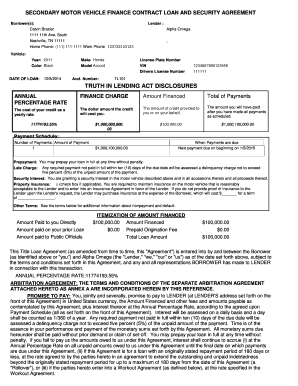

Chattel Mortgage Agreement

Installment Sale Agreement

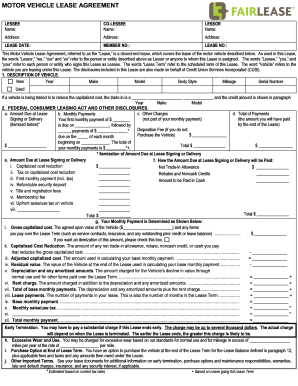

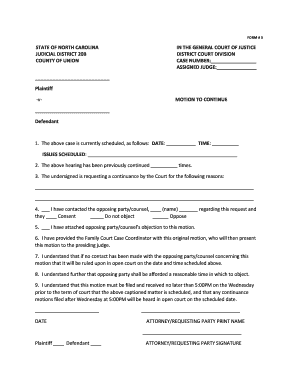

How to complete Security agreement form for vehicle

Completing a Security agreement form for a vehicle is a simple process that involves the following steps:

01

Fill in the borrower and lender information

02

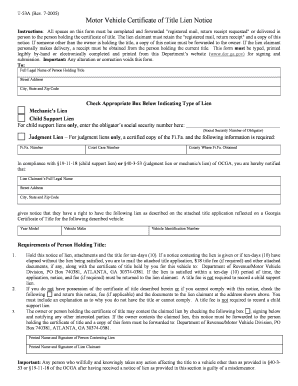

Describe the vehicle being used as collateral

03

Outline the terms of the loan agreement, including interest rate and repayment schedule

04

Sign and date the form to make it legally binding

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Security agreement form for vehicle

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is a security agreement the same as a note?

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

What is a personal security agreement?

A “SECURITY AGREEMENT” is an agreement that. creates or provides for an interest in personal property. that secures payment or performance of an obligation.

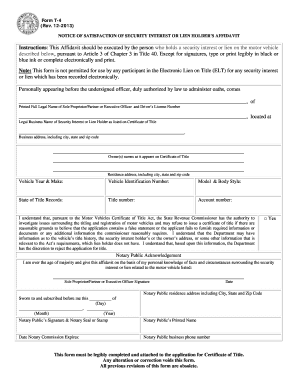

What makes a security agreement valid?

The security agreement must: be signed (or authenticated) by the debtor and the owner of the property, contain a description of the collateral and. make it clear that a security interest is intended.

What is a security agreement on a car?

When placing the car loan, you also sign a “security agreement.” This security agreement gives the bank a “Security Interest” in the “Collateral” or “Security Property” (the car). The security agreement gives the bank the right to go against the collateral (car) if you default.

How do I make a security agreement?

Creating a security agreement Some key provisions in a security agreement include: Describing the collateral as accurately and as detailed as possible, so both the borrower and the lender agree upon the secured property. How to determine whether and when the borrower is in default under the loan.

What is a security agreement form?

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.