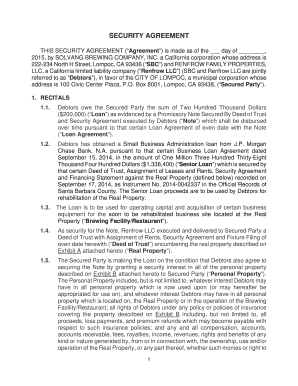

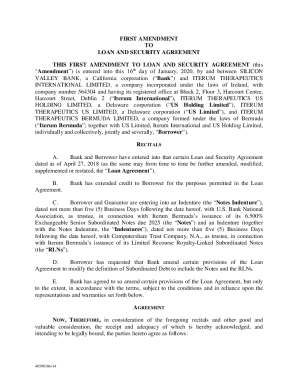

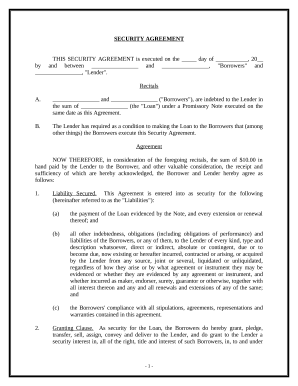

California Security Agreement

What is a California security agreement?

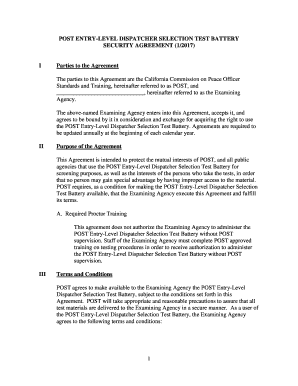

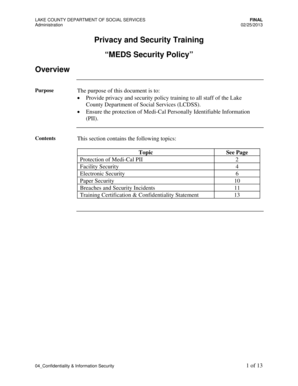

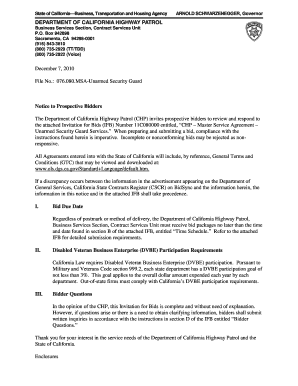

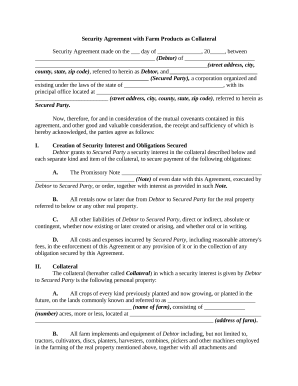

A California security agreement is a legal contract that ensures the repayment of a loan or the fulfillment of an obligation by allowing a lender to take possession of specific assets provided as collateral in case of default. It is a crucial document in transactions where the lender needs reassurance that the borrower will fulfill their obligations.

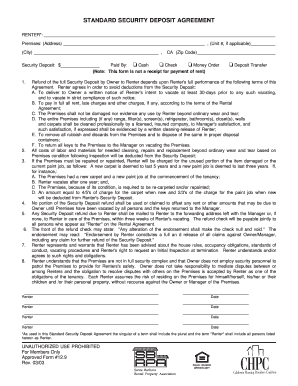

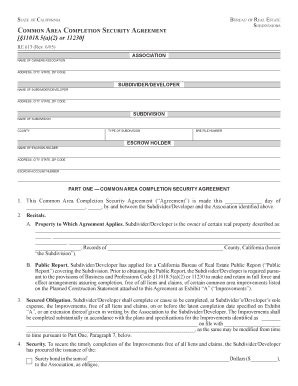

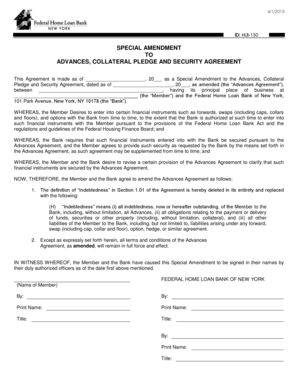

What are the types of California security agreements?

In California, there are mainly two types of security agreements: real property security agreements and personal property security agreements.

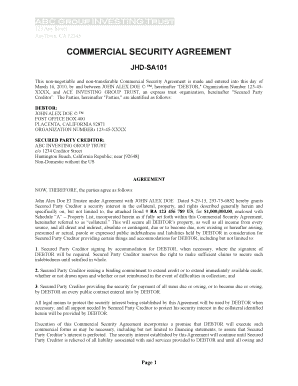

How to complete a California security agreement

Completing a California security agreement is a straightforward process that involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.