Security Agreement Form For Vehicle

What is Security agreement form for vehicle?

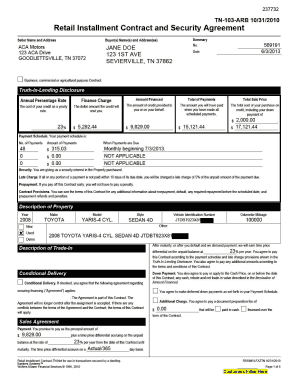

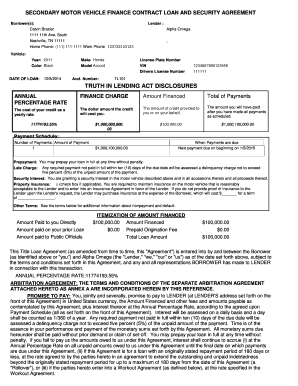

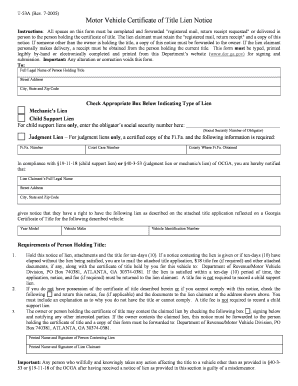

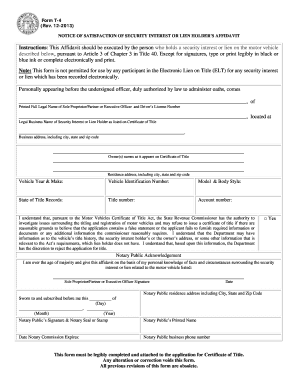

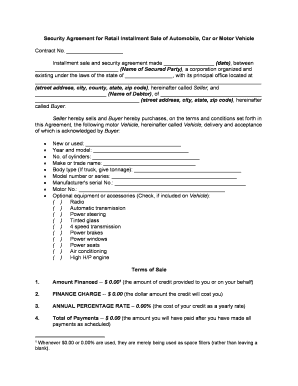

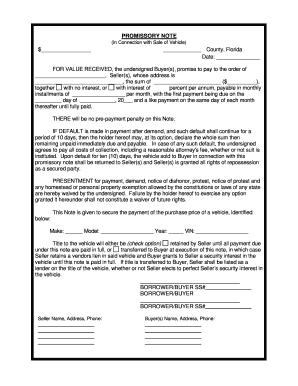

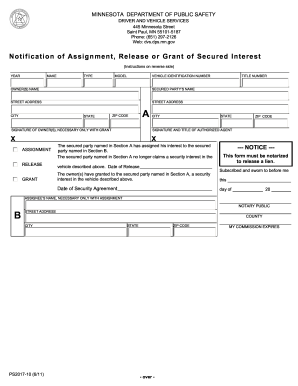

A Security agreement form for a vehicle is a legal document that outlines the terms and conditions of a loan used to purchase a vehicle. It establishes a security interest in the vehicle, giving the lender the right to repossess the vehicle if the borrower defaults on the loan.

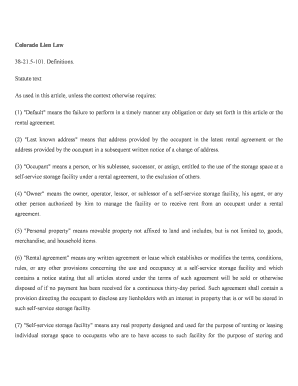

What are the types of Security agreement form for vehicle?

There are several types of Security agreement forms for vehicles, including: 1. Chattel Mortgage 2. Conditional Sale Agreement 3. Hire Purchase Agreement 4. Lease Agreement 5. Personal Property Security Agreement

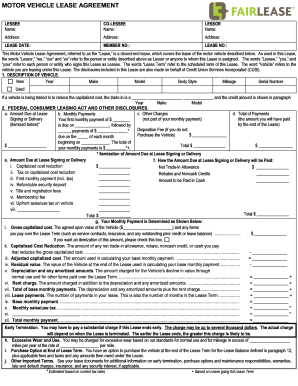

How to complete Security agreement form for vehicle

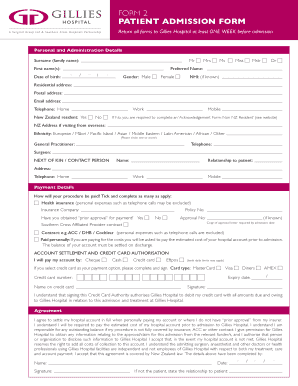

Completing a Security agreement form for a vehicle is a straightforward process. Here are the steps to follow: 1. Fill in the borrower's and lender's details 2. Describe the vehicle being used as collateral 3. Outline the terms of the loan, including interest rates and repayment schedule 4. Sign and date the agreement 5. Make a copy for your records

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.