Security Agreement Form Ucc - Page 2

What is Security agreement form UCC?

A Security Agreement Form UCC is a legal document that outlines the terms and conditions agreed upon between a borrower and a lender regarding the collateral securing a loan. This form is governed by the Uniform Commercial Code (UCC) to ensure consistency and enforcement of security agreements across different states.

What are the types of Security agreement form UCC?

There are several types of Security Agreement Form UCC, including: 1. Specific Collateral: This type lists specific assets that are used as collateral for the loan. 2. Blanket Liens: This type covers all present and future assets of the borrower as collateral. 3. Pledged Accounts: This type involves using bank accounts as collateral for the loan. 4. Equipment Finance Agreements: This type secures equipment purchased with the loan.

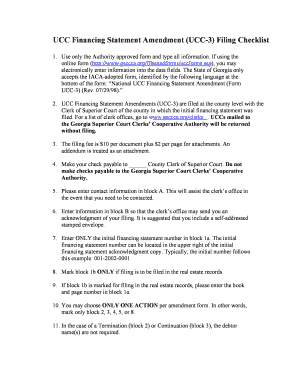

How to complete Security agreement form UCC

Completing a Security Agreement Form UCC is a straightforward process that involves the following steps: 1. Gather all necessary information about the borrower, lender, and collateral. 2. Fill out the form with accurate details and ensure all parties sign the agreement. 3. File the form with the appropriate authorities as required by the UCC regulations to establish the security interest. 4. Keep a copy of the completed form for your records and provide a copy to all parties involved.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.