Home Insurance Claim Form Templates

What are Home Insurance Claim Form Templates?

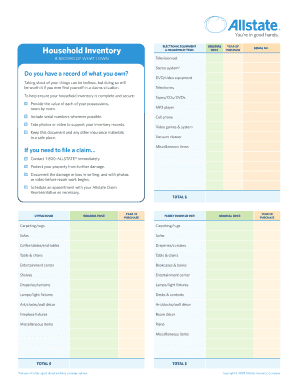

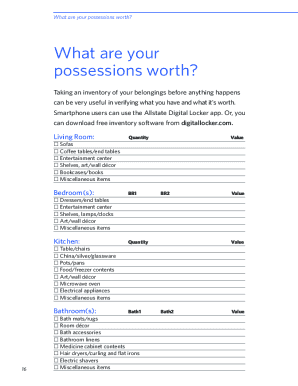

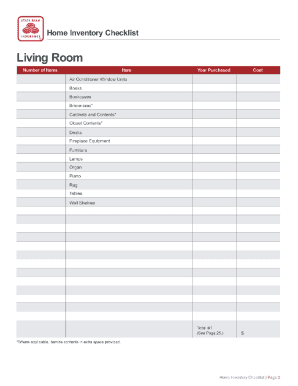

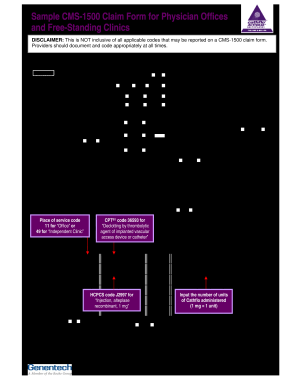

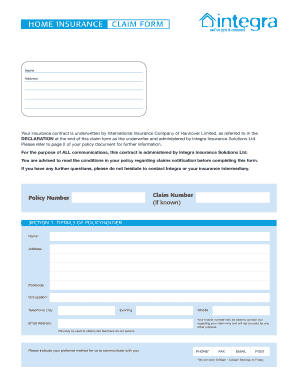

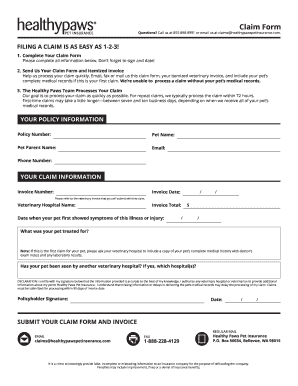

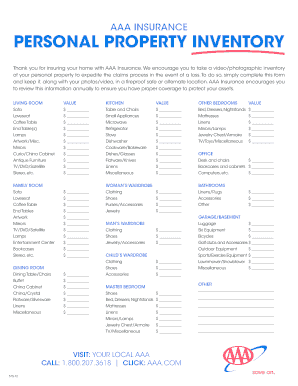

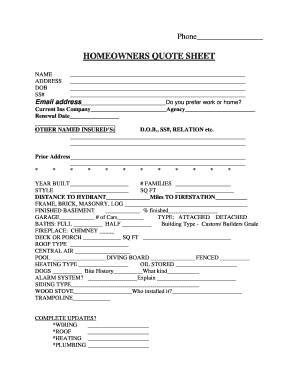

Home Insurance Claim Form Templates are pre-designed forms that help homeowners easily document and submit claims to their insurance company in the event of property damage or loss. These templates typically include sections for personal information, details of the incident, property information, and any supporting documents.

What are the types of Home Insurance Claim Form Templates?

There are several types of Home Insurance Claim Form Templates available, including: Standard claim forms for general property damage, Theft claim forms for stolen items, Fire damage claim forms for damages caused by fires, Water damage claim forms for incidents like burst pipes or flooding, and Natural disaster claim forms for events like hurricanes or earthquakes.

How to complete Home Insurance Claim Form Templates

Completing Home Insurance Claim Form Templates is easy with the right approach. Here are the steps to follow: 1. Gather all necessary information and supporting documents before you start filling out the form. 2. Fill in your personal details accurately, including your name, address, and contact information. 3. Provide a detailed description of the incident, including when and where it occurred. 4. Detail the damages or losses incurred and the estimated cost of repairs or replacements. 5. Attach any relevant photos, receipts, or other documentation to support your claim.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.